📉 TL;DR – Last Week in 60 Seconds

Stocks started 2026 with a wobble: higher U.S. Treasury yields kept a lid on risk, and the S&P 500 slipped for the week. The 10-year Treasury yield rose to above 4.19% as investors looked ahead to this week’s U.S. jobs data. Thin holiday trading made moves feel bigger, and big-tech leaders cooled after a strong 2025.

The dollar firmed, while metals took a sharp step down, before recovering over the weekend. Headlines also turned geopolitical: the U.S. struck Venezuela and seized President Nicolás Maduro, but oil stayed relatively calm because supply still looks ample.

Quick Levels → Last week’s change

S&P 500: 6,858.48 | ↓1.03% Nasdaq 100: 25,206.17 | ↓1.71% Dow: 48,382.40 | ↓0.67% Russell 2000: 2,508.22 | ↓1.03% | Gold/oz: $4,332 | ↓4.44% Silver/oz: $72.82 | ↓8.18% Bitcoin (BTC): $91,450 | ↑4.08% DXY (US Dollar Index): 98.43 | ↑0.39% |

🚀 Top Movers Last Week

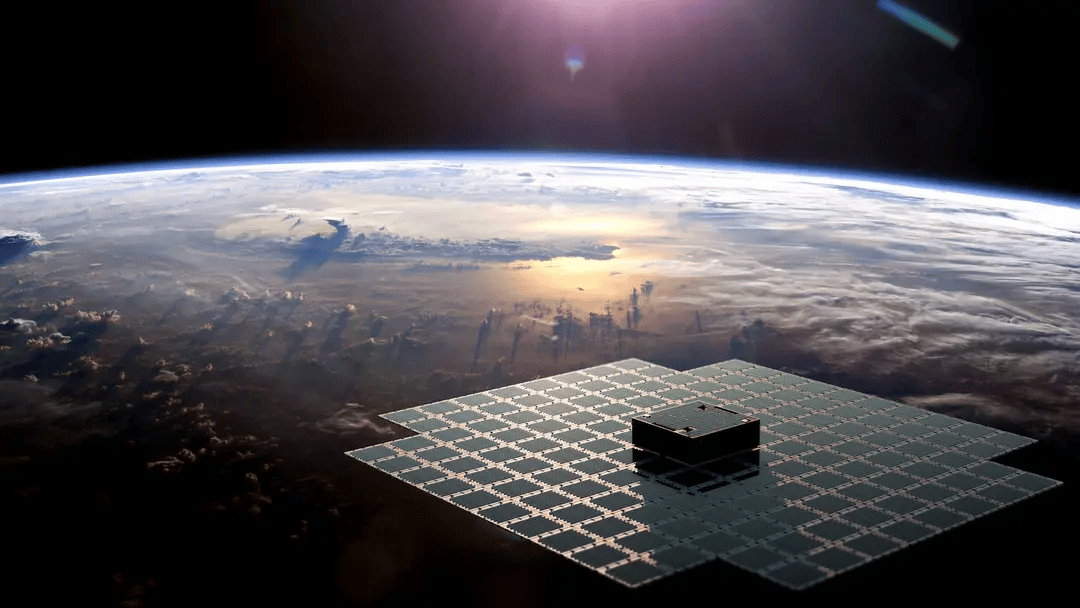

Source: AST SpaceMobile

Baidu (BIDU) ↑20.43% — Its AI-chip unit Kunlunxin confidentially filed for a Hong Kong IPO, sparked investor excitement.

AST SpaceMobile (ASTS) ↑16.01% — A successful BlueBird 6 satellite launch kept the direct-to-phone narrative buzzing in 2026 plans.

Symbotic (SYM) ↑11.86% — Analyst price-target hikes followed strong guidance, extending the warehouse-automation rally into January.

Taiwan Semiconductor (TSM) ↑5.54% — Nvidia sought higher H200 production at TSMC, reinforcing the AI server demand story.

Palantir (PLTR) ↓11.05% — Software sold off as money rotated into chips; profit-taking after a huge 2025.

Tesla (TSLA) ↓7.81% — Shares sank after annual deliveries fell again, losing the EV crown to BYD and raising questions about demand and tax credits.

🗺 Market Map

ISM check-in: Manufacturing PMI* hits Monday, Jan 5 (10 AM ET); Services PMI* follows Wednesday, Jan 7 (10 AM ET). Above 50 = expansion. Strong prints could lift the dollar and yields; soft readings would revive rate-cut hopes.

Jobs week: JOLTS* arrives Wednesday, Jan 7 (10 AM ET). The full Employment Situation—nonfarm payrolls and unemployment rate—lands Friday, Jan 9 (8:30 AM ET). Hot labor data risks delaying Fed cuts; cooler numbers would ease financial conditions.

Energy is the swing factor: Washington’s move in Venezuela raises questions about sanctions, exports, and who controls supply. Near-term disruptions can lift gasoline risk; longer-term, more Venezuelan barrels could actually cool crude prices (WTI currently ~$57/barrel).

Crypto got a flow boost: U.S. spot Bitcoin exchange-traded funds (ETFs) took in about $471M on Jan. 2, flipping the tape back to inflows. When ETF demand returns, Bitcoin often stabilizes sooner after pullbacks.

Fed watch: Speeches from policymakers (including Kashkari and Barkin) can quickly nudge markets. If they emphasize “sticky” inflation, Treasury yields (the interest rates on U.S. government bonds) may rise—usually tougher on growth stocks.

A word from Attio…

AI-native CRM

“When I first opened Attio, I instantly got the feeling this was the next generation of CRM.”

— Margaret Shen, Head of GTM at Modal

Attio is the AI-native CRM for modern teams. With automatic enrichment, call intelligence, AI agents, flexible workflows and more, Attio works for any business and only takes minutes to set up.

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

🛒 Buy Zone

Long-term investors: After a shaky start, think “rebalance, not react.” If stocks dip into the jobs data, dollar-cost averaging into broad index funds and adding a touch of quality cash-flow sectors (health care, staples) can smooth the ride.

Short-term traders: This week is “data-driven.” Watch how the Nasdaq responds right after ISM and Friday’s payrolls. A lower-yield reaction could spark a quick relief rally; a higher-yield spike can fade it fast. Risk guardrail: size smaller into releases, and respect last week’s lows as the line in the sand.

💡 Signal Spotlight

Venezuela’s oil reset, and why markets care

The U.S. says it’s taking control in Venezuela, and it’s already tying that to rebuilding the country’s oil industry.

For markets, the fast channel is oil: geopolitical uncertainty can tack on a risk premium* and lift inflation fears. The slower channel is supply: meaningful production gains likely take time and big investment.

👀 What to Watch

Mon, Jan 5 — ISM Manufacturing PMI: First big demand read of 2026. Strong demand can lift yields; weak can do the opposite.

Wed, Jan 7 — ISM Services PMI: Services drive inflation; rate-sensitive sectors react.

Wed, Jan 7 — JOLTS openings: Shows labor demand; shapes wage-pressure expectations.

Thu, Jan 8 — Jobless claims + Productivity: Layoff pulse and output efficiency.

Thu, Jan 8 — U.S. trade balance: A wider deficit can lift GDP math, but can also boost the dollar if imports cool.

Fri, Jan 9 — Employment Situation (includes Dec. Nonfarm Payrolls + Unemployment Rate): Jobs, wages, unemployment; biggest driver for Fed bets.

Fri, Jan 9 — University of Michigan Consumer Sentiment (prelim.): A read on household confidence and inflation expectations.

📚 Decoder

ISM Manufacturing PMI (Purchasing Managers Index): Factory survey; above 50 expands, below 50 contracts.

ISM Services PMI: Service-sector survey; big for inflation and interest-rate expectations.

JOLTS (Job Openings and Labor Turnover Survey): Tracks openings, quits, layoffs; signals labor demand strength.

Risk premium: Extra price investors pay for uncertainty, especially geopolitics.

🕔 That’s your 5-minute guide to start the week. There’s more info out there…dive in! News is free; risk isn’t.

We’ll be back to check-in on Thursday at 7 AM ET.

Educational only—not investment advice.