📈 TL;DR — What Moved, What Didn’t

Stocks cooled off Wednesday after a hot start to 2026. The S&P 500 slipped on yesterday, its first down day in four, while the Dow fell off Tuesday’s record high. Tech held up better, with the Nasdaq still green, as investors kept leaning into the AI spending story.

Small caps are still leading the week, but homebuilder stocks took a hit after President Trump announced limits on big investors buying single-family homes. Softer labor signals (JOLTS job openings and ADP payrolls) kept rates jumpy ahead of Friday’s jobs report.

Quick Levels → Week-to-date change

S&P 500: 6,920.92 | ↑0.91% Nasdaq 100: 25,653.90 | ↑1.78% Dow: 48,996.09 | ↑1.27% Russell 2000: 2,575.42 | ↑2.68% | Gold/oz: $4,421 | ↑2.08% Silver/oz: $75.32 | ↑3.43% Bitcoin (BTC): $90,242 | ↓1.36% DXY (US Dollar Index): 98.73 | ↑0.30% |

🚀 Top Movers This Week

Critical Metals Corp (CRML) ↑69.33% — Greenland pilot-plant construction approval boosted Tanbreez rare-earth project optimism, fueling a surge.

SanDisk (SNDK) ↑28.46% — Nvidia’s CES comments reignited AI storage demand, sending memory stocks sharply higher.

Oklo (OKLO) ↑25.45% — Signed a DOE agreement for a radioisotope pilot facility, fueling “nuclear renaissance” hopes.

AeroVironment (AVAV) ↑24.31% — Defense jitters and analyst target hikes pushed the drone-maker higher amid geopolitical headlines.

First Solar (FSLR) ↓12.11% — Jefferies downgrade to “Hold” sparked a sharp selloff; policy and booking visibility worries lingered.

😶 Market Mood

Source: USAF

This week’s vibe: mixed growth signals, choppy rates, and a big Friday test. ISM Manufacturing PMI* fell to 47.9 (below 50 = shrinking), and bond markets leaned “slower growth,” nudging Treasury yields lower. Then ISM Services PMI* popped to 54.4 (above 50 = growing) and services hiring turned positive—but input prices stayed elevated, keeping inflation nerves in the room.

Defense got its own twist: President Trump floated a $1.5T defense budget for 2027 and warned contractors on buybacks/dividends—U.S. names dipped while European peers jumped. Next up, is Friday’s Nonfarm Payrolls (NFP)*—forecasts sit roughly ~60k–73k jobs, with unemployment around 4.5%.

Scenarios (next 1–2 weeks)

👌 Base Case (Choppy): Jobs data lands “good-not-great.” NFP keeps the Fed in wait-and-see mode. Stocks digest early-January strength without a big break, yields stay rangebound, and oil staying soft eases near-term inflation fears.

☀️ Bull Case (Calm → Choppy): Payroll growth cools and wage pressure eases. Rate expectations drift lower, lifting rate-sensitive growth stocks. Softer crude reinforces the “inflation fading” story, and risk appetite improves without needing blockbuster earnings surprises.

🌩 Bear Case (Stormy): NFP and wages run hot. Yields and the dollar push higher, and stocks reprice quickly (especially expensive tech). Oil could snap back on geopolitics, making inflation worries louder again and keeping volatility elevated.

A word from Finance Buzz…

Amazon Prime members: See what you could get, no strings attached

If you spend a good amount on Amazon, do not ignore this. This card could put $100s back every year and gives you the chance to earn cash back on the purchases you already make. You could get approved extremely fast and unlock a massive welcome bonus instantly. Amazon Prime members: See what you could get, no strings attached

🔍 Chart of the Week

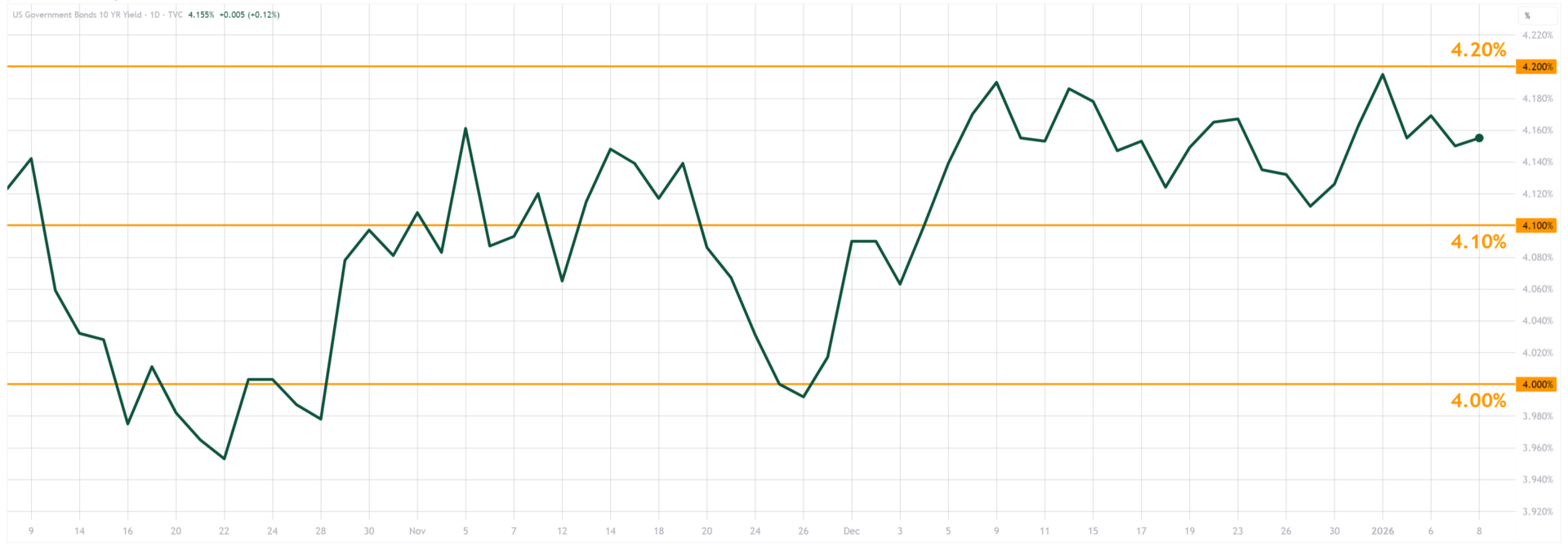

10-year “Guideline”

Symbol: U.S. 10-year Treasury yield (DGS10)

Timeframe: Daily, last 3 months through Jan 7, 2026

Key levels: 4.00% support | 4.10% pivot | 4.20% resistance

Why it matters: Base case is “choppy but contained,” and the 10-year yield is the steering wheel. If Friday’s jobs report pushes yields above ~4.20%, expect more stock wobble; below ~4.00% favors a relief bounce.

🏠 Wall St. to Main St.

Gas: AAA’s national average is about $2.82/gal, helped by softer WTI crude.

Mortgage costs: The average 30-year fixed sits near 6.15%. If the 10-year Treasury slips from ~4.15%, lenders usually follow.

Oil: WTI* has been hanging in the mid-to-high $50s, which is a tailwind for shipping costs and some everyday goods.

Plastic is pricey: Average credit-card APRs near 19–20%; paying balances down delivers a near-certain “return.”

🚪 Weekly Close

The early-week rotation has been about breadth: smaller stocks have grabbed the spotlight, while leadership has started to spread beyond the biggest names. Financials have been a standout as investors focus on bank earnings and a yield curve that’s been friendlier to lenders.

Energy has been the speed bump, with crude sliding on oversupply worries and Venezuela-related supply headlines. The near-term setup is simple: if Friday’s jobs print is calm, the market can keep building on its January footing; if it’s hot, rate-sensitive areas can wobble fast. Incoming next week: inflation prints plus the first major earnings wave.

What to watch:

Thu, Jan 8 — Jobless claims + Productivity: Layoff pulse and output efficiency.

Thu, Jan 8 — U.S. trade balance: A wider deficit can lift GDP math, but can also boost the dollar if imports cool.

Fri, Jan 9 — Employment Situation (includes Dec. Nonfarm Payrolls + Unemployment Rate): Jobs, wages, unemployment; biggest driver for Fed bets.

Fri, Jan 9 — University of Michigan Consumer Sentiment (prelim.): A read on household confidence and inflation expectations.

Tue, Jan 13 — CPI*: Headline inflation test after year-end demand and energy moves.

Tue, Jan 13 — Big-bank earnings kick off: JPMorgan starts; guidance sets tone.

Wed, Jan 14 — PPI*: Wholesale inflation that can feed into future CPI.

📚 Decoder

CPI (Consumer Price Index): Monthly inflation report for household goods and services.

Institutional investors: Large funds like pensions/hedge funds; move big money fast.

ISM Manufacturing PMI: Factory survey; above 50 expands, below 50 contracts.

ISM Services PMI: Service-sector survey; big for inflation and interest-rate expectations.

NFP (Nonfarm Payrolls): Monthly U.S. jobs count excluding farm workers.

PPI (Producer Price Index): Inflation measure at wholesale/producer level before retail.

WTI: Main US crude oil benchmark; used to price gasoline and energy.

🕔 That wraps up your midweek 5-minute brief. There’s more info out there…dive in! News is free; risk isn’t.

We’ll be back before opening bell next Monday, at 7 AM ET. Be on the lookout for your next update from 5 Minute Markets.

Educational only—not investment advice.