📈 TL;DR — What Moved, What Didn’t

Stocks kept the Santa rally rolling in a holiday-shortened week. Investors leaned “risk-on,” but the leadership was picky: large growth led, while small caps lagged. Tuesday’s Q3 GDP* report showed the U.S. economy grew at a 4.3% annual pace in Q3, and the S&P 500 hit a fresh record close.

Wednesday extended the streak: the S&P and Dow finished at new all-time highs, even with thin trading ahead of Christmas. Gold & Silver reached new records, while the U.S. dollar softened. Meanwhile, ETF flows showed classic year-end rebalancing, with big index redemptions, even as prices held up. Markets are closed today for the holiday.

Quick Levels → Week-to-date change

S&P 500: 6,932.04 | ↑1.43%

Nasdaq 100: 25,656.15 | ↑1.22%

Dow: 48,731.17 | ↑1.24%

Russell 2000: 2,548.08 | ↑0.74%

Gold/oz: $4,479 | ↑3.24%

Bitcoin (BTC): $87,365 | ↓1.45%

DXY (U.S. Dollar Index): 97.95 | ↓0.78%

🚀 Top Movers This Week

Source: Michael Siluk/Alamy

Intuitive Machines (LUNR) ↑11.85% — Closed KinetX acquisition; investors eye 2026 lunar mission cadence. Executive orders aimed at ensuring America’s superiority in space, kept Space-stock momentum strong in thin volume.

Novo Nordisk (NVO) ↑9.30% — U.S. approval of a GLP-1 weight-loss pill (previously only injectable) stoked optimism and sparked a sharp rebound.

Micron (MU) ↑7.81% — Earnings beat and upbeat AI-memory demand kept the chip-upgrade story alive.

Freeport-McMoRan (FCX) ↑5.64% — Copper prices flirted with record highs; Freeport hit a 15-month high on momentum.

Trump Media & Technology (DJT) ↓11.06% — Post-merger euphoria faded; profit-taking hit harder with low liquidity before Christmas break.

😎 Market Mood

Markets spent this week reacting to the data, not the headlines. The BEA’s* Q3 GDP initial estimate came in at 4.3% (annually), pointing to sturdy demand. But the inflation side was warmer: Core PCE* (prices excluding food and energy) ran at a 2.9% pace in Q3, keeping rate-cut hopes from getting too excited.

Then weekly jobless claims* fell to 214,000, while continuing claims rose to 1.923M—low layoffs, softer hiring. Treasuries barely moved after the report, a sign that investors see “steady” not “recession.” Big tech held leadership, while small caps lagged as funding costs stayed elevated.

Scenarios (next 1–2 weeks)

👌 Base Case (Calm): Growth supports earnings, but inflation keeps the Fed patient. Stocks grind sideways with narrow leadership. If yields stay contained after year-end data, dips likely find buyers rather than turning into a bigger slide.

☀️ Bull Case (Choppy): Inflation cools in the next read, and continuing claims stop climbing. Yields ease, giving growth stocks more oxygen. A push toward the next round-number level becomes realistic if breadth improves beyond the mega-caps.

🌩 Bear Case (Stormy): Inflation re-accelerates or jobless claims jump post-holiday. Yields pop, pressuring high-priced tech first. Investors rotate defensive and raise cash. A decisive break below support would shift the tone from “pause” to “protect profits.”

A word from EverQuote…

Don’t let 2026 hit without reviewing your 2025 rates!

With the year wrapping up and winter weather on the way, it’s a great time to revisit your insurance rates. Driving habits shift, pricing changes, and holiday travel adds new risks. Use EverQuote to compare trusted carriers, confirm your coverage, and get the best price heading into the colder months.

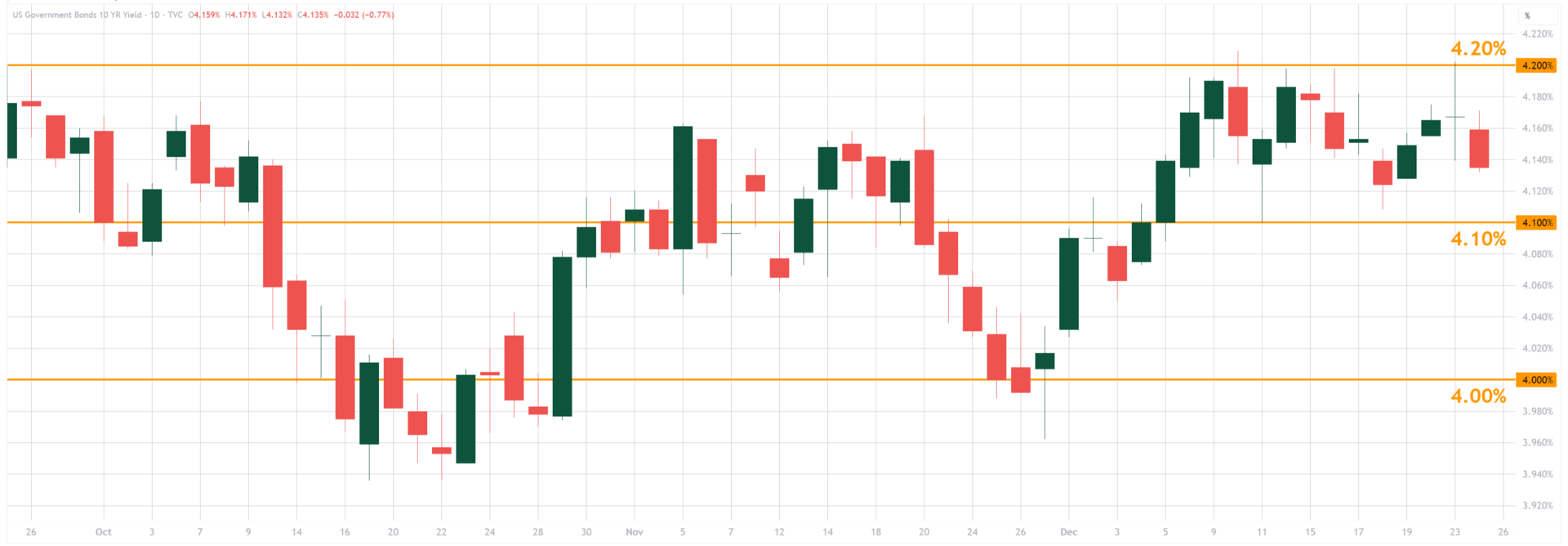

🔍 Chart of the Week

Holiday Lid on Valuations

Symbol: US 10-Yr Treasury yield (DGS10)

Timeframe: Daily, last 3 months through Dec 24, 2025

Key levels: 4.00% (support), 4.10% (pivot), 4.20% (resistance)

Why it matters: A sustained move above ~4.20% tightens valuations and encourages rotation; a drop back below 4.00% eases pressure and supports growth stocks and Gold.

🏠 Wall St. to Main St.

Mortgage check: The average 30-year fixed mortgage rate is 6.18%. Small dip, still pricey for first-time buyers.

Gas station relief: AAA’s national average is about $2.85/gal; a tailwind for holiday driving budgets.

Grocery inflation cooled: “Food at home” ran ↑1.9% year-over-year in November, slower than earlier in 2025. Helps budgets—even if overall prices are still high versus 2020–2022.

Precious metals rally: With gold, silver, and copper near or above record highs, costs can creep up for jewelry, electronics, home wiring, appliances, and car/EV parts—often first seen in repairs and renovation quotes.

🚪 Weekly Close

This week’s leadership stayed concentrated in Technology (↑4.98%), followed by Communication Services, Basic Materials, and Industrials—while Consumer Defensive (↓1.33%) lagged. That “growth-first” sector mix also fits the 2025 backdrop: investors preferred offense, over bunker plays.

One caution: year-end rebalancing* plus lighter liquidity can turn small headlines into bigger swings around support and resistance levels. Keep an eye on rates: the 10-year near 4.14% is still the market’s mood thermostat.

What to watch:

Thu, Dec 25 — U.S. markets closed (Christmas)

Fri, Dec 26 — Regular trading resumes: watch for “catch-up” moves on light volume.

Mon, Dec 29 — Pending Home Sales: housing demand check with rates still high.

Mon, Dec 29 — Dallas Fed survey: fresh read on factory demand/pricing.

Tue, Dec 30 — Chicago PMI: late-month activity pulse for manufacturing.

Tue, Dec 30 — State JOLTS* (State Job Openings and Labor Turnover): labor demand by state.

Thu, Jan 1 — U.S. markets closed (New Year’s Day)

📚 Decoder

BEA (Bureau of Economic Analysis): Publishes GDP, trade, income, and spending data.

Core PCE: Inflation gauge excluding food and energy; Fed watches closely.

GDP (Gross Domestic Product): Total output of the economy; growth signal for markets.

Jobless claims: Weekly count of people filing first-time unemployment benefits.

JOLTS (Job Openings and Labor Turnover Survey): Tracks openings, quits, layoffs; signals labor demand strength.

Year-end rebalancing: Investors reset portfolio weights as markets and calendar roll over.

🕔 That wraps up your midweek 5-minute brief. There’s more info out there…dive in! News is free; risk isn’t.

We’ll be back before opening bell next Monday, at 7 AM ET. Be on the lookout for your next update from 5 Minute Markets.

Educational only—not investment advice.