📉 TL;DR — What Moved, What Didn’t

Big banks’ earnings helped stocks grind higher, with small caps leading the charge. Gold broke above $4,200/oz as traders leaned into Fed-rate-cut bets and safe-haven demand, while the dollar slipped. Bitcoin lagged stocks, giving back some early-October gains as risk appetite refocused on equities. Bond yields were little changed around 4.03% on the 10-year—supportive, but not a tailwind.

Quick Levels → Week-to-date change

S&P 500: 6,671.06 | ↑0.73%

Nasdaq 100: 24,745.36 | ↑0.49%

Dow: 46,253.31 | ↑1.21%

Russell 2000: 2,519.75 | ↑3.99%

Gold (oz): $4,209.51 | ↑4.75%

Bitcoin (BTC): $110,767.40 | ↓3.67%

DXY (U.S. dollar): 98.79 | ↓0.15%

🚀 Top Movers This Week

Source: Bloomberg

Advanced Micro Devices (AMD): ↑11.03% — Target hikes and AI-chip optimism kept buyers active after upbeat notes.

Prologis (PLD) | ↑10.37% — Strong Q3 beat and outlook; warehouse leasing momentum surprised to the upside.

Bank of America (BAC): ↑7.46% — Beat earnings and raised net interest income guidance; shares re-rated.

Morgan Stanley (MS) | ↑7.11% — Record revenue/profit; dealmaking and trading strong, pipeline flagged as “record.”

Bitcoin (BTC) | ↓3.71% — Post-liquidation hangover as U.S.–China tensions damp risk appetite.

😎 Market Mood

Earnings strength from big banks, AI-infrastructure news, and slightly softer dollar supported risk. The 10-year yield hovered near ~4.02%, while ETFs saw hefty inflows last week, led by bonds and metals. Headliner: a BlackRock-, Microsoft-, and NVIDIA-backed group agreed to buy Aligned Data Centers for ~$40B—validating multi-year spend on infrastructure that feeds AI: power, real estate, and long-lead assets.

Scenarios (next 1–2 weeks)

👌 Base Case (Choppy): Earnings stay “good enough,” 10-year holds ~4.0%–4.2%, and breadth improves led by small caps and financials. Trade noise lingers but fades intraday; pullbacks get bought before options expiry.

☀️ Bull Case (Calm/Choppy): Softer yields and constructive guidance push new highs; chips re-lead and credit stays loose. ETF inflows persist, keeping dips shallow as positioning chases performance into month-end.

🌩 Bear Case (Stormy): Trade tensions escalate, yields jump, and dollar firms; tech and small caps slip first while haven buying lifts gold. Tightening liquidity shows up in funding markets.

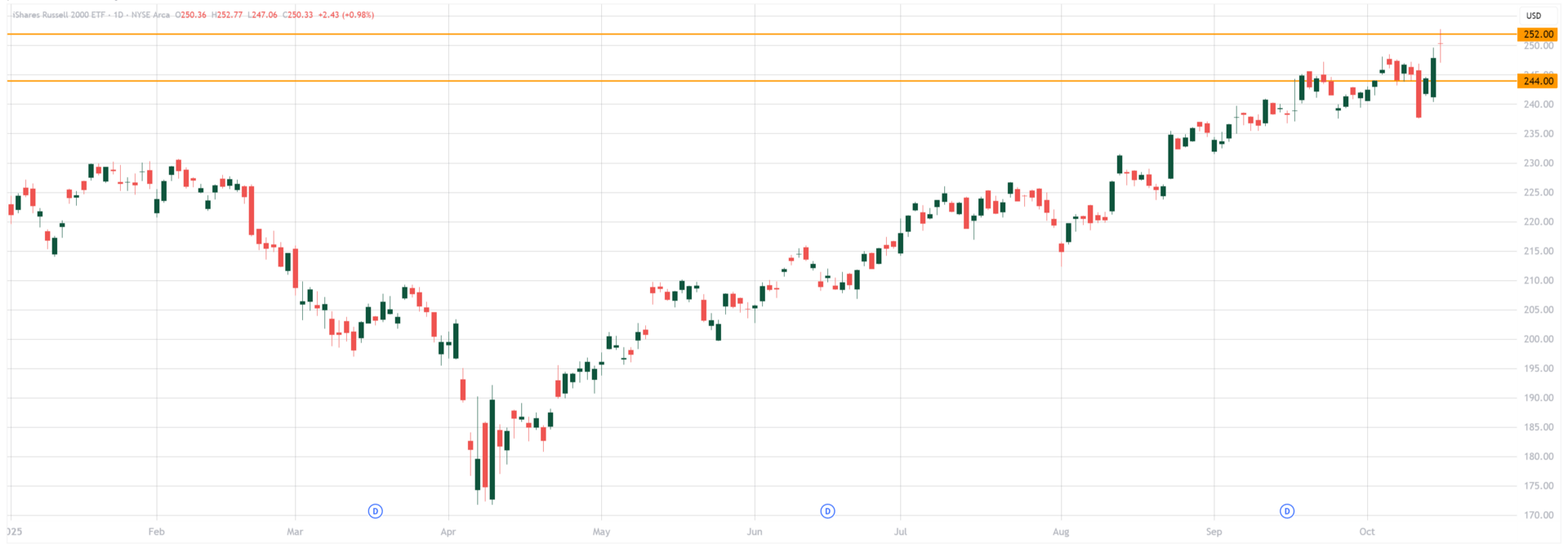

🔍 Chart of the Week

Symbol: $IWM (Russell 2000 ETF) — “Breakout Test”

Timeframe: YTD daily, through Oct 15, 2025

Key levels: 244–245 = new support (prior range); 252–253 = first resistance (Wed high 252.77); watch 250 as a pivot.

Why it matters: Holding 244–245 keeps the small-cap rebound intact; a close above 252 would confirm risk appetite beyond mega-caps. Lose 244 and this week’s breadth pop likely fades.

🏠 Wall St. to Main St.

Mortgage payments eased a bit: the 30-year fixed averaged 6.30% last week, the lowest in ~1 year. That trims monthly costs for buyers and refi-eligible owners.

Gas is cheaper: the national average is $3.07/gal (regular). Lower pump prices free up cash for groceries and bills.

Government shutdown: TSA and air-traffic staff working with partial/uncertain pay have contributed to delays; national parks face closures or limited services. Plan travel accordingly.

Benefits & safety net: SNAP* October payments are proceeding, but officials warn a prolonged lapse could strain programs like WIC*.

Small-business lifeline: New SBA 7(a)* and 504 loans* are largely paused, slowing expansions and equipment purchases.

🚪 Weekly Close

Markets lean cautiously into the weekend. The big wild card: U.S.–China trade-war threats around rare earths*. Fresh Chinese export curbs and possible U.S. responses could hit EVs, chip supply chains, wind turbines, and defense magnets—lifting input costs and volatility in materials and selected tech. Meanwhile, the federal shutdown* still darkens key data, keeping PMIs and the Fed in focus. Bottom line: headline risk is elevated; liquidity pockets around options expiry can magnify moves.

What to watch

Thu, Oct 16 – Freddie Mac PMMS*: Fresh mortgage-rate print; sub-6.25% would aid affordability.

Fri, Oct 17 – Monthly options expiration: Dealer positioning can amplify late-week swings.

Tue, Oct 21 — EIA gas/diesel update: Fresh pump-price trend; impacts budgets and freight.

Thu, Oct 23 — Existing Home Sales: Real-time look at resale activity and housing supply.

Thu, Oct 23 — S&P Global Flash PMI: Early read on October factory/services momentum.

Fri, Oct 24 — Durable Goods Orders**: Core capex signal for business demand.

Fri, Oct 24 — CPI (rescheduled)**: Headline read on inflation returns; watch shelter and services.

Fri, Oct 24 – Univ. Michigan Sentiment (final): Confidence update; inflation expectations matter for rates.

**May be delayed due to the federal government shutdown.

📚 Decoder

504 loan: SBA-backed fixed-rate loan for equipment or real estate.

7(a) loan: SBA’s main small-business loan guaranteeing bank financing.

Durable Goods Orders: Monthly orders for long-lasting goods; proxy for business investment.

PMMS: Freddie Mac’s weekly national mortgage-rate survey.

Rare earths: critical elements (e.g., neodymium) used in high-strength permanent magnets.

Shutdown: ongoing federal funding lapse; BLS/BEA data paused until government reopens.

SNAP: Federal food assistance benefits loaded monthly to EBT cards.

WIC: Nutrition support for women, infants, and children via state agencies.

🕔 That wraps up your midweek 5-minute brief. There’s more info out there…dive in! News is free; risk isn’t.

We’ll be back before opening bell next Monday, at 7 AM ET. Be on the lookout for your next update from 5 Minute Markets.

Educational only—not investment advice.

A word from Masterworks…

Where to Invest $100,000 According to Experts

Investors face a dilemma. Headlines everywhere say tariffs and AI hype are distorting public markets.

Now, the S&P is trading at over 30x earnings—a level historically linked to crashes.

And the Fed is lowering rates, potentially adding fuel to the fire.

Bloomberg asked where experts would personally invest $100,000 for their September edition. One surprising answer? Art.

It’s what billionaires like Bezos, Gates, and the Rockefellers have used to diversify for decades.

Why?

Contemporary art prices have appreciated 11.2% annually on average

…And with one of the lowest correlations to stocks of any major asset class (Masterworks data, 1995-2024).

Ultra-high net worth collectors (>$50M) allocated 25% of their portfolios to art on average. (UBS, 2024)

Thanks to the world’s premiere art investing platform, now anyone can access works by legends like Banksy, Basquiat, and Picasso—without needing millions. Want in? Shares in new offerings can sell quickly but…

*Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.