📉 TL;DR – Last Week in 60 Seconds

Odds of a December Fed rate cut fell to ~46% last week, as officials signaled patience and recent data ran hot. That kept 10-year Treasury yields hovering near 4.15%. Stocks were mixed: the S&P 500 barely rose; the Dow inched up, the Nasdaq 100 slipped, and small caps fell. Bitcoin dropped ~10%; gold cooled; the dollar eased.

The message: rotation is underway as investors digest rate talk, and adjust year-end positioning around the “higher for longer” theme lasting a bit longer. This week, watch Fed meeting minutes, housing data, and global PMI (Purchasing Managers’ Index) surveys for growth signals. Moves in rates and the dollar will likely steer sector leadership and decide whether buyers defend dips.

Quick Levels → Last week’s change

S&P 500: 6,734.10 | ↑0.08%

Nasdaq 100: 25,008.24 | ↓0.21%

Dow: 47,147.49 | ↑0.34%

Russell 2000: 2,388.23 | ↓1.83%

Gold/oz: $4,085 | ↑2.11%

Bitcoin (BTC): $94,290 | ↓9.97%

U.S. Dollar Index (DXY): 99.27 | ↓0.28%

🚀 Top Movers Last Week

Cypherpunk Technologies (CYPH) ↑500.04% — Rebranded from Leap Therapeutics. $50M Zcash treasury pivot and Winklevoss-led funding, sparked speculative surge.

Eli Lilly (LLY) ↑10.92% — Obesity-drug access deal and GLP-1* demand (Mounjaro/Zepbound) powered record results; management raised full-year guidance.

Strategy (MSTR) ↓17.43% — Tumbled with Bitcoin’s drop; leveraged BTC exposure magnified downside.

Alibaba (BABA) ↓7.54% — Shares slid on White House memo alleging Chinese military (PLA*) links; company denied; geopolitical risk weighed.

Tesla (TSLA) ↓5.86% — China sales hit a three-year low in October amid fierce local competition.

🗺 Market Map

Source: SAM YEH/Getty Images

Rate-cut odds faded. Traders marked down chances of a December move by the U.S. central bank, after hotter inflation chatter and mixed growth signals; that lifted yields and weighed on richly valued growth shares.

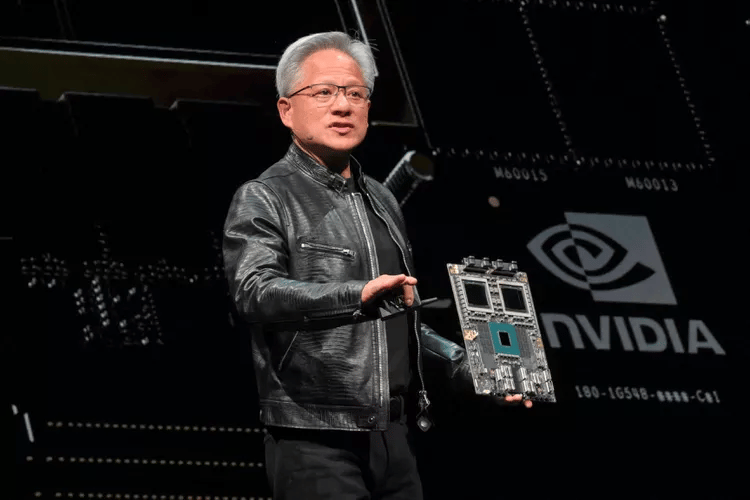

Earnings gauntlet: Nvidia, Walmart, Target, and Home Depot report. Retail results will test consumer spending strength, and home-improvement resilience. Guidance tone likely sets near-term sector leaders and laggards. Nvidia is the AI barometer: watch data-center growth, Blackwell ramp, margins, and cloud capex commentary. A miss or soft guide could sway mega-cap tech and indexes.

Energy geopolitics: Trump backed a Senate push for 500% tariffs on buyers of Russian oil. If advanced, it could reroute crude flows, lift shipping costs, and nudge inflation expectations—especially for India and China.

FAA lifting all flight restrictions at 40 major airports. Sunday’s announcement means normal schedules resumed Monday 6 a.m. ET—tailwind for airlines, airports, holiday travel demand, and jet-fuel.

Flows turned cautious last week. Equity inflows slowed sharply; gold funds attracted cash, hinting at a modest safety bid as policy uncertainty and shutdown-related data gaps lingered.

🛒 Buy Zone

Long-term investors — Health Care looks attractive on a “trend pullback.” The sector has lagged the market in 2025, leaving valuations more reasonable versus growth leaders. Demographics and steady cash flows help in slowdowns. Consider gradual adds via diversified funds, not single names. Watch policy noise; it can move prices short term.

Short-term traders — Small caps (Russell 2000) are in a bounce-or-break spot after underperforming. A cluster of rescheduled data this week could swing rates and risk appetite; expect faster moves. If trading, define risk tightly and avoid holding through major releases.

💡 Signal Spotlight

The Data Dam Is About to Burst.

A shutdown-driven data drought is ending—but not with a neat dump. BLS* says some October staples (jobs, CPI) likely won’t arrive, while BEA* drip-feeds catch-up reports starting Nov 19. Less data = bigger market reactions to each print, especially at 8:30 a.m. ET. Watch BEA and BLS calendars for surprises, and expect choppier swings in rates, the dollar, and rate-sensitive stocks until schedules normalize.

A word from Fisher Investments…

7 Actionable Ways to Achieve a Comfortable Retirement

Your dream retirement isn’t going to fund itself—that’s what your portfolio is for.

When generating income for a comfortable retirement, there are countless options to weigh. Muni bonds, dividends, REITs, Master Limited Partnerships—each comes with risk and oppor-tunity.

The Definitive Guide to Retirement Income from Fisher investments shows you ways you can position your portfolio to help you maintain or improve your lifestyle in retirement.

It also highlights common mistakes, such as tax mistakes, that can make a substantial differ-ence as you plan your well-deserved future.

👀 What to Watch

All week — Corporate guidance: Earnings calls from software, retail, and energy; listen for holiday demand and capex plans.

Tue, Nov 18 — NAHB Housing Market Index: Builder confidence update as mortgage rates stabilize.

Wed, Nov 19 — BEA U.S. Trade (Aug): goods/services gap shapes GDP* nowcast*.

Wed, Nov 19 — NVIDIA earnings (after close): AI spending pulse check for chips, data centers, and tech leadership.

Wed, Nov 19 — FOMC minutes*: clues on timing/size of next policy moves.

Thu, Nov 20 — Weekly Jobless Claims: First look at labor demand; sensitive given recent data gaps.

Thu, Nov 20 — Philly Fed Index: Fresh read on manufacturing momentum.

Thu, Nov 20 — Existing Home Sales: Housing turnover lens for brokers, movers, and home-related retail.

Thu, Nov 20 — Walmart earnings (pre-market): Holiday readiness: traffic, pricing, and inventory commentary.

Fri, Nov 21 — S&P Global Flash PMIs & Michigan Sentiment Final: Growth pulse + confidence check to end the week.

📚 Decoder

BEA (Bureau of Economic Analysis): Publishes GDP, trade, income, and spending data.

BLS (Bureau of Labor Statistics): Publishes jobs, CPI inflation, wages, and productivity reports.

FOMC Minutes: Summary of the Fed’s last policy meeting discussion.

GDP (Gross Domestic Product): Total value of goods and services produced domestically.

GDP nowcast: Real-time estimate of current-quarter GDP using partial data.

GLP-1 (Glucagon-Like Peptide-1): Hormones and drugs that lower blood sugar and appetite; weight loss treatments.

PLA (People’s Liberation Army): China’s military; relevant for corporate ties and geopolitical risk.

🕔 That’s your 5-minute guide to start the week. There’s more info out there…dive in! News is free; risk isn’t.

We’ll be back to check-in on Thursday at 7 AM ET.

Educational only—not investment advice.