📉 TL;DR – Last Week in 60 Seconds

The Fed cut rates by 0.25% and hinted at a pause next, keeping markets guessing about 2026. Stocks enter the week a little bruised: the S&P 500 slipped while the tech led the pullback, but the Dow and small caps held up. Investors are acting picky—rewarding steady earners and punishing “growth” stocks.

Gold jumped and the U.S. dollar eased, a classic sign of mild “risk-off” positioning. Bitcoin slid over the weekend. The biggest speed bump ahead is Thursday’s Consumer Price Index (CPI)* inflation report.

Quick Levels → Last week’s change

S&P 500: 6,827.42 | ↓0.63%

Nasdaq 100: 25,196.73 | ↓1.93%

Dow: 48,458.06 | ↑1.05%

Russell 2000: 2,551.46 | ↑1.19%

Gold/oz: $4,300 | ↑2.40%

Bitcoin (BTC): $89,169 | ↓2.50%

DXY (U.S. Dollar index): 98.39 | ↓0.60%

🚀 Top Movers Last Week

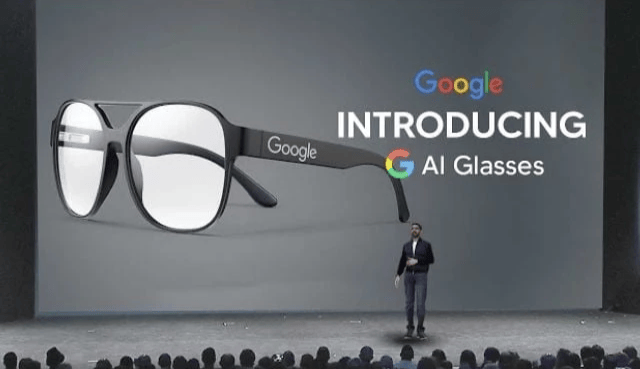

Source: Alphabet

Tilray Brands (TLRY) ↑65.31% — Report Trump may move marijuana to Schedule III, a less-restricted category, sparked cannabis rally.

Warby Parker (WRBY) ↑45.98% — Google partnership to build AI smart glasses (due 2026) kicked off a speculative surge.

Carvana Co. (CVNA) ↑13.99% — S&P 500 addition news sparked buying from funds that track the index, boosting momentum.

Oracle (ORCL): ↓12.69% — Missed forecasts, heavier AI data-center spending, and reports of data centers for OpenAI being delayed to 2028 revived bubble fears; debt and spending worries deepened.

Broadcom (AVGO) ↓7.77% — Margin warning tied to AI system sales spooked investors, triggering profit-taking in a giant chipmaker.

🗺 Market Map

The Fed cut its policy rate by 0.25% on Dec 10, but the vote was split and officials hinted at a pause. Translation: fewer cuts priced for 2026, harder for “easy money” to return. Long-term borrowing costs didn’t relax much, the 10-year Treasury ended Friday near 4.18%. That keeps pressure on mortgages and companies that need cheap financing.

Key price data lands this week: November CPI is due Dec 18 after delays. Nowcasts point to modest monthly gains, while early December consumer sentiment ticked up—still low versus history. Any upside inflation surprise could re-lift yields.

BLS jobs data (Dec 16): The Employment Situation report lands after shutdown delays. It may be “noisy” (less reliable), but traders will still use it to push bond yields—and growth stocks—around.

Commodities are mixed: Brent sits near $61 after a sharp monthly slide, but Venezuela-related supply risk steadies prices. Gold and Silver hover around highs as the dollar softens and yields drift. Oil weakness tempers gas-price pressure.

🛒 Buy Zone

Long-term investors: with the 10-year yield still close to ~4.2%, it’s a good time to favor “cash now” businesses—quality dividends and value-style (cheaper, steadier earners) funds—over story stocks that need cheap money. Keep it broad and gradual.

Short-term traders: Gold breakout watch — Prices pushed to seven-week highs as the dollar eased. Look for a retest/hold above the recent breakout area; momentum traders tend to buy dips while DXY stays subdued. Guardrail: renewed dollar strength or hot CPI often knocks gold.

💡 Signal Spotlight

The Fed’s Statement, and what markets heard

The Fed cut 0.25% and signaled “watch the data.” The SEP shows the future median funds rate near 3.6% → 3.4% → 3.1%, with inflation gliding toward 2%.

Markets’ first read: stocks ↑, yields ↓, dollar ↓. One wrinkle: the statement allows short-term Treasury buys to keep bank reserves “ample” (plumbing, not QE*). Bottom line: gentle path lower for rates—unless CPI or jobs re-accelerate.

A word from EverQuote…

Don’t let 2026 hit without reviewing your 2025 rates!

With the year wrapping up and winter weather on the way, it’s a great time to revisit your insurance rates. Driving habits shift, pricing changes, and holiday travel adds new risks. Use EverQuote to compare trusted carriers, confirm your coverage, and get the best price heading into the colder months.

👀 What to Watch

Mon, Dec 15 — Empire State Manufacturing + NAHB housing sentiment: early read on factories and homebuilder confidence.

Tue, Dec 16 — BLS Employment Situation (Nov): first full jobs read since shutdown; watch wages and participation.

Tue, Dec 16 — S&P Global flash PMIs*: Fresh read on growth momentum and pricing power.

Wed, Dec 17 — EIA crude inventories: can nudge gas-price expectations and inflation narratives.

Thu, Dec 18 — CPI (Nov): First inflation print post-Fed; data quality caveats still apply.

Thu, Dec 18 — Jobless claims*: Timeliest labor gauge; watch for seasonal noise vs trend.

Fri, Dec 19 — Existing-home sales (Nov)*: Turnover and affordability check as mortgage rates ease.

Fri, Dec 19 — Quadruple witching: options expirations can amplify market moves into the close.

📚 Decoder

CPI (Consumer Price Index): Monthly inflation report for household goods and services.

Existing-home sales: Completed property sales; signals housing demand and affordability.

Flash PMI: Early survey of factory/services activity; tracks growth and prices.

Jobless claims: Weekly applications for unemployment benefits; near-real-time labor signal.

QE (Quantitative Easing): Central bank buys bonds to lower yields and boost liquidity.

🕔 That’s your 5-minute guide to start the week. There’s more info out there…dive in! News is free; risk isn’t.

We’ll be back to check-in on Thursday at 7 AM ET.

Educational only—not investment advice.