📈 TL;DR — What Moved, What Didn’t

Oracle’s moon-shot AI deals lifted mega-cap tech and pushed the S&P 500 and Nasdaq to fresh records Wednesday. Wholesale inflation (PPI*) cooled, helping Treasury yields* ease and gold mark new highs.

The Dow lagged on Apple weakness, while small-caps slipped. The dollar was little changed and Bitcoin firmed as flows steadied ahead of today’s CPI*.

Quick Levels → Week-to-date change

S&P 500: 6,532.04 | ↑0.52%

Nasdaq 100: 23,849.27 | ↑0.38%

Dow: 45,490.92 | ↑0.13%

Russell 2000: 2,378.01 | ↓0.74%

Gold/oz: $3,645.11 | ↑1.63%

Bitcoin (BTC): $113,963.50 | ↑2.54%

U.S. Dollar Index (DXY): 97.86 | ↑0.07%

🚀 Top Movers This Week

Oracle (ORCL): ↑39.00% — Blowout AI cloud contracts sent shares vertical; Larry Ellison briefly became the world’s richest man after $100B+ single-day gain.

Broadcom (AVGO): ↑9.77% — Post-earnings pop as AI chip revenue and backlog outpaced expectations.

Nvidia (NVDA): ↑5.80% — Oracle’s capex plans reinforced demand for GPUs; AI spending fears eased.

Apple (AAPL): ↓2.00% — “Awe-Dropping” iPhone event landed flat with Wall St.; shares drifted lower.

AMD (AMD): ↑5.37% — Chipmaker gains on data center tailwinds and AI server momentum.

😎 Market Mood

Mega-cap tech carried indexes after Oracle’s big rally, while small-caps lagged. Treasury yields eased into Thursday’s Consumer Price Index (CPI), helping growth stocks.

The 10-year yield hovered near 4.08% (down from last week’s 4.22%), keeping the U.S. dollar range-bound and gold bid.

Scenarios (next 1–2 weeks)

👌 Base Case (60%, Choppy): One tame CPI keeps 10-yr near ~4.00–4.15%; tech leadership persists, breadth mixed. Watch retail sales and earnings for confirmation.

☀️ Bull Case (25%, Calm): CPI cools and core services slow; yields slip toward 3.90%, broadening the rally to cyclicals* and small-caps.

🌩 Bear Case (15%, Spiking): CPI re-accelerates; 10-yr backs up above 4.25%, pressuring high-duration tech and pushing dollar higher.

🔍 Chart of the Week

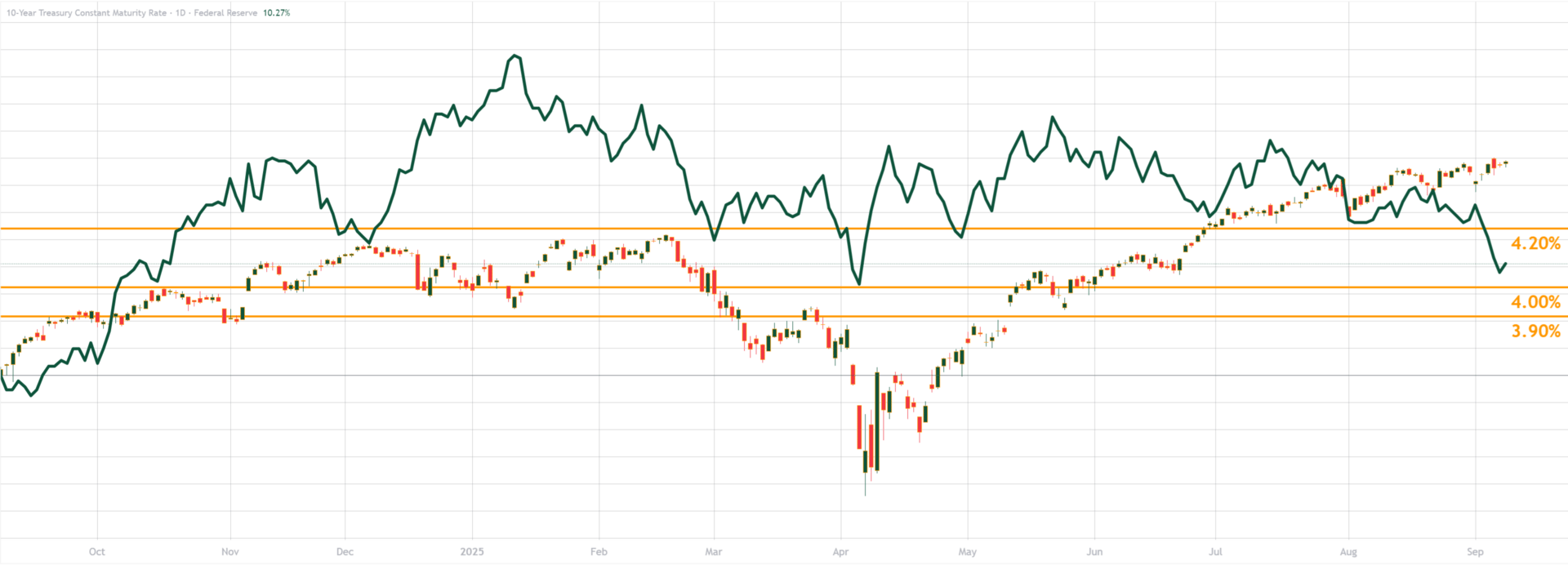

US 10-Year Treasury vs. S&P 500

Timeframe: Daily chart; 1-year window through Sep 10, 2025

Key levels: 3.90% support, 4.00% pivot, 4.20% resistance

Why it matters: Our Base Case leans on yields staying near ~4%. A break below 4.0% would fuel growth; a push above 4.2% risks a tech fade.

🏠 Wall St. to Main St.

Mortgage rates: The 30-year fixed sits near ~6.49%–6.50%, the lowest since Oct ’24, and refi activity just jumped. A 0.25% rate drop trims ~$1.20/month per $10k on a 5-year auto loan.

Gas: The national average for regular is ~$3.19/gal, little changed week-over-week. That’s helpful for fall travel budgets.

Prices: Today’s CPI print sets the tone for paychecks vs. prices; a softer reading would ease pressure on household budgets.

What changes next: If the Fed cuts Sep 17, credit-card APRs tied to prime can edge down—and high-yield savings may slip too.

🚪 Weekly Close

Rotation this week favored cyclical growth (semiconductors, comms. platforms) while defensives* lagged, as traders refocused from AI headlines to inflation and next week’s Fed decision. Cooler oil argues for a softer Energy trade, while steadier credit and contained volatility favor gradual dips-to-buy in quality.

Into Friday, monitor breadth metrics, ETF flows into equal-weight funds*, and long-bond demand—signals that could set the tone for next week.

Upcoming catalysts:

Thu, Sept 11 — CPI (Aug): Core path guides cut odds; watch shelter, services. 8:30am ET.

Thu, Sept 11 — Initial Jobless Claims: Labor cooling or stabilizing? Leading spending signal. 8:30am ET.

Fri, Sept 12 — Michigan Consumer Sentiment (prelim): Inflation expectations drive rates, gas-price outlook. 10am ET.

Tue, Sept 16 — Retail Sales (Aug): Back-to-school strength vs gas prices; real-demand pulse. 8:30am ET.

Tue–Wed, Sept 16–17 — FOMC decision: Rate move, dots, presser steer yields, dollar. 2pm ET Wed.

Wed, Sept 17 — Housing Starts & Permits (Aug): Pulse for mortgages, builders, demand. 8:30am ET.

Fri, Sep 19 – Triple witching: Quarterly options/futures expirations; often boosts volume and volatility.

📚 Decoder

30-year Treasury auction: U.S. sale of new 30-year bonds to investors.

Basis point (bp): One-hundredth of a percentage point (0.01%).

Breadth: How many stocks are rising versus falling.

CPI (Consumer Price Index): Monthly inflation report tracking consumer price changes.

Cyclicals: Stocks whose profits move with the economy, e.g., retail, industrials, materials.

Defensives: Stocks less tied to economy; staples, utilities, health care.

Equal-weight funds: Indexes or ETFs weighting each stock equally, not by market cap.

FOMC: Fed Reserve Bank committee that sets interest rates and policy guidance.

Michigan Consumer Sentiment: Survey of household finances and buying conditions.

PPI (Producer Price Index): Wholesale inflation report—prices businesses receive.

Refinance (refi) share: Portion of mortgage applications that are refinances.

WTI crude: Benchmark U.S. oil price quoted per barrel.

Yield (2-yr, 10-yr, etc.): Interest rate paid by U.S. Treasury securities.

🕔 That wraps up your midweek 5-minute brief. There’s more info out there…dive in! News is free; risk isn’t.

We’ll be back before opening bell next Monday, at 7 AM ET. Meanwhile, be sure to check out our “3 after 5” weekly recap online Saturday afternoon.

Educational only—not investment advice.