📉 TL;DR — What Moved, What Didn’t

Tech kicked off November with a pop after Amazon’s $38B pact with OpenAI, but gains faded as investors weighed spending and rates. By Wednesday, small caps bounced while mega-cap tech steadied; the S&P 500 is down week-to-date.

The 10-year yield hovered near ~4.15% and the dollar firmed, keeping gold in check. Bitcoin briefly slipped below $100K midweek on ETF outflows before recovering. Volatility rose from Monday’s levels but eased into Wednesday’s close.

Quick Levels → Week-to-date change

S&P 500: 6,796.29 | ↓0.64%

Nasdaq 100: 25,620.03 | ↓0.92%

Dow: 47,311.00 | ↓0.53%

Russell 2000: 2,464.78 | ↓0.59%

Gold/oz: $4,005 | ↑0.06%

Bitcoin (BTC): $103,118 | ↓6.76%

DXY (U.S. Dollar Index): 100.17 | ↑0.45%

🚀 Top Movers This Week

Source: Getty Images

Kenvue (KVUE): ↑12.94% — Spiked on report of a Kimberly-Clark takeover plan, lifting consumer staples niche.

Toast (TOST) ↑7.97% — Q3 revenue beat, ARR* topped $2B, ~7,500 net new locations.

Eli Lilly (LLY): ↑7.30% — Obesity-drug momentum: new $3B plant and policy chatter boosted sentiment.

Super Micro (SMCI): ↓19.11% — Post-earnings drop on margin pressure even as guidance moved higher.

Palantir (PLTR): ↓6.27% — raised outlook on strong AI demand, yet valuation hangover, broad tech weakness, and headlines on Michael Burry’s $912M bearish position pressured sentiment.

😶 Market Mood

Mixed signals kept trading choppy. Private payrolls rose 42k in October, hinting at slower hiring. Manufacturing stayed in contraction (ISM Manufacturing 48.7), while services expanded (ISM Services 52.4). Earnings moved single names: Uber’s miss weighed on growth, Qualcomm’s tax-charge headline muddied otherwise solid guidance, and Apple’s record September-quarter metrics lingered from late last week.

Net: decent services activity, soft jobs pulse, and event-driven stock swings—enough to cap rallies, but not to break the tape.

Scenarios (next 1–2 weeks)

👌 Base Case (Choppy): Services stays above 50 and jobs cool; indexes range-trade as traders fade spikes and buy dips selectively. Watch next week’s earnings guidance and private data for direction.

☀️ Bull Case (Spiking): Softer jobs + tamer price surveys push yields lower; mega-caps catch a bid and cyclicals follow on better services demand. Upside accelerates on clean earnings beats.

🌩 Bear Case (Stormy): A hot jobs print or steep services-prices jump revives rate fears; growth stocks lag and defensive rotation returns. Guidance cuts from heavyweights would add pressure.

🔍 Chart of the Week

6,740–6,900: Decision Box

Symbol: S&P 500 (SPX)

Timeframe: Daily, last 3 months through Nov 5, 2025

Key levels: 6,740 support; 6,900 resistance; 6,700 risk guardrail

Why it matters: Holding above 6,740–6,800 and the 50-day keeps the pullback routine. A daily close >6,900 points toward 7,000+. A break <6,700 likely invites broader de-risking and weaker breadth.

🏠 Wall St. to Main St.

Air travel: FAA will trim flights by ~10% in 40 big markets—expect delays.

Food aid: November SNAP is partially funded; some states face payout lags.

Rents: Apartment List shows median rent ↓0.8% m/m in October; tenants have more leverage.

Gas: National average $3.08/gal today; trending lower vs. a month ago.

Energy: WTI* near $61.79—helps gas but signals softer global growth; natural gas futures firmed near ~$4.30 into heating season.

Household debt: Q3 balances hit $18.59T; student-loan delinquencies rising—watch budgets.

Mortgages: 30-yr fixed fell for four straight weeks; last reading 6.17% (week of Oct 30). Today’s update due.

🚪 Weekly Close

Rotation stayed cautious: semis wobbled while energy steadied on supply headlines and steady weekly oil data. Defensives perked up selectively as investors navigated the data blackout.

Into next week, watch liquidity around Treasury auctions and private-sector gauges that aren’t halted. Government numbers like CPI and retail sales remain stuck until funding returns—flag that in calendars.

What to watch:

Thu, Nov 6 — Freddie Mac PMMS*: Weekly mortgage-rate update—key for housing demand.

Thu–Fri, Nov 6–7 — Fed speeches: Policy tone can sway cut expectations and dollar/yields quickly.

Fri, Nov 7 — Univ. of Michigan consumer sentiment* (prelim): Spending confidence and inflation expectations.

Fri, Nov 7 — Consumer Credit (Fed G.19): Window into card borrowing.

Thu, Nov 13 — Disney earnings: Big S&P 500 bellwether for media and parks.

TBD — (Delayed by gov’t shutdown): CPI, PPI, retail sales, housing starts.

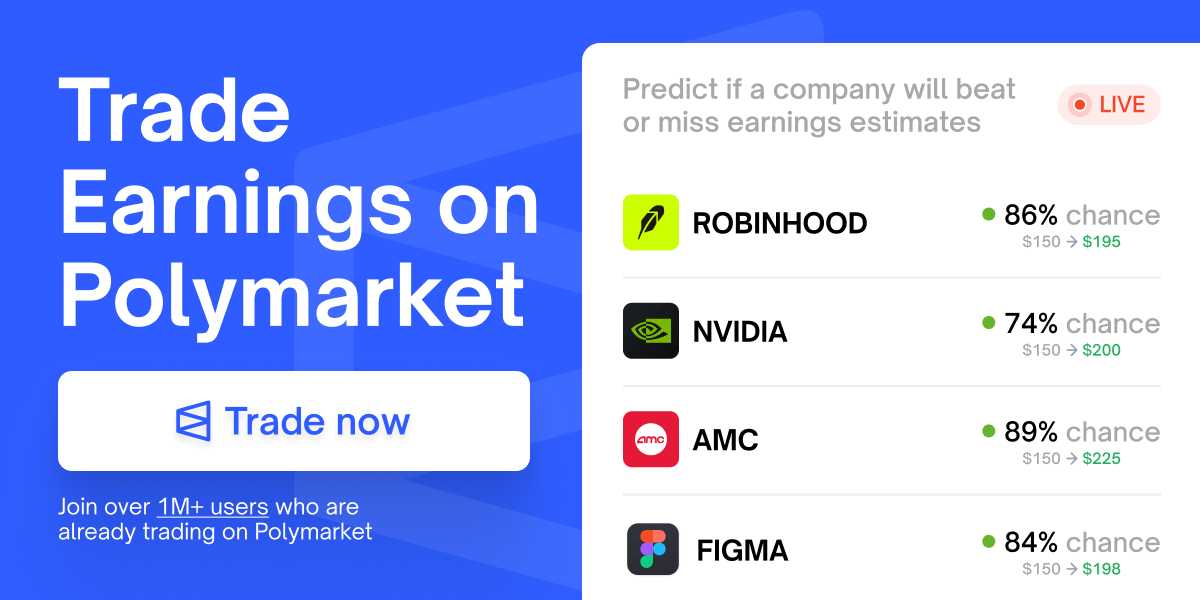

A word from Polymarket…

JUST IN: Earning Markets on Polymarket 🚨

Polymarket, the world's largest prediction market, has rolled out Earnings Markets. You can now place a simple Yes/No trade on specific outcomes:

Will HOOD beat earnings?

Will NVDA mention China?

Will AMC beat estimated EPS?

Profit directly from your conviction on an earnings beat, regardless of the immediate stock movement.

Why trade Earnings Markets?

Simple: Clear Yes/No outcomes.

Focused: Isolate the specific event you care about.

Flexible: Tight control for entry, hedging, or exit strategy.

Upcoming markets include FIGMA, ROBINHOOD, AMC, NVIDIA, and more. Built for how traders actually trade.

📚 Decoder

ARR (Annual Recurring Revenue): Subscription revenue expected each year from existing contracts and customers.

Consumer sentiment (Michigan): Survey of household views on finances and economy.

PMMS (Primary Mortgage Market Survey): Freddie Mac’s weekly average mortgage-rate survey.

WTI (West Texas Intermediate): Benchmark U.S. crude oil price.

🕔 That wraps up your midweek 5-minute brief. There’s more info out there…dive in! News is free; risk isn’t.

We’ll be back before opening bell next Monday, at 7 AM ET. Be on the lookout for your next update from 5 Minute Markets.

Educational only—not investment advice.