📈 TL;DR — What Moved, What Didn’t

S&P 500 is slightly higher WTD, while the Nasdaq 100 slipped as Netflix tumbled 10% post-earnings. Treasury yields eased—10-year near 3.97%—and the Dow outperformed. The dollar ticked up. Gold reversed after a record run, posting its biggest single-day drop in years. Bitcoin gave back part of Tuesday’s jump.

Rate-cut bets firmed as investors see the Fed easing again into year-end, keeping the 10-year below 4.0%. Into today: earnings stay in focus (Tesla and peers), with markets watching yields, the dollar, and any trade/shutdown global headlines that could sway risk appetite.

Quick Levels → Week-to-date change

S&P 500: 6,699.40 | ↑0.14%

Nasdaq 100: 24,879.01 | ↓0.45%

Dow: 46,590.41 | ↑0.60%

Russell 2000: 2,451.55 | ↓0.79%

Gold/oz: $4,088.05 | ↓3.85%

BTC: $107,587.50 | ↓0.98%

DXY (U.S. dollar index): 98.90 | ↑0.23%

🚀 Top Movers This Week

Source: Beyond Meat

Beyond Meat (BYND): ↑454.52% — Meme-style squeeze after Walmart distribution headlines; liquidity surged and volatility spiked.

Halliburton (HAL): ↑18.14% — Oilfield services rallied with crude’s rebound on Russia sanctions headlines.

Netflix (NFLX): ↓6.92% — Earnings hit by Brazil tax dispute; Q4 outlook underwhelmed lofty expectations.

PHLX Gold/Silver Index (XAU): ↓6.68% — Gold’s pullback from records hit miners hardest; stronger dollar and profit-taking weighed.

Apple (AAPL): ↑2.44% — New iPhone 17 demand sent shares to records Monday; midweek pullback trimmed gains.

😶 Market Mood

It’s been choppy…Bond yields hover near ~4% on the 10-year, easing from earlier highs but not breaking lower decisively. Energy bounced mid-week while gold miners cracked. Mega-cap leadership is uneven, and small-caps remain rate-sensitive. Net: range-bound indices, sector rotations under the surface.

Scenarios (next 1–2 weeks)

👌 Base Case (Choppy): 10-year holds near ~4.00%; stocks chop in a range. Energy stabilizes; miners lag. Earnings guide the tape day-to-day; breadth stays mixed. Watch small-caps for rate-beta tells.

☀️ Bull Case (Calm): Yields drift toward 3.85–3.90%; growth breathes, cyclicals follow if oil steadies. Better-than-feared earnings lift mega-caps; dip-buyers rotate into laggards.

🌩 Bear Case (Stormy): Yields pop back above ~4.15%; small-caps and rate-sensitives buckle. Dollar firm; gold miners extend slide. Earnings misses or cautious outlooks sap risk appetite.

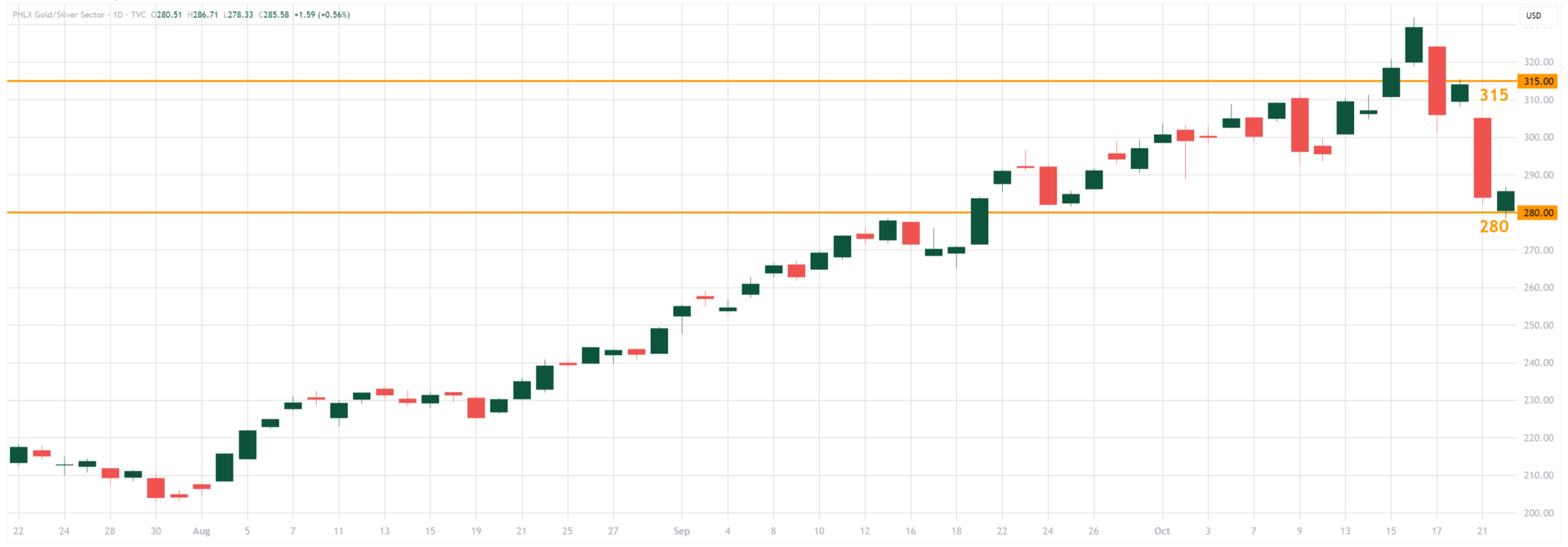

🔍 Chart of the Week

Symbol: $XAU (PHLX Gold/Silver Index)

Timeframe: Daily, last 3 months through Oct 22, 2025

Key levels: 280 support; 305–315 resistance zone

Why it matters: Miners just unwound a chunk of the gold spike. Holding ~280 keeps pullback within uptrend. A sustained break risks broader risk-off as gold enthusiasm fades; reclaiming 305–315 would restore momentum and support the base-case “chop.”

🏠 Wall St. to Main St.

Gas is easing: the national average sits near $3.07/gal—a four-year low zone as demand softens. That helps grocery and delivery costs, too.

Mortgages hover: near ~6.27% (30-year, last week), keeping payments below last winter’s peaks.

Wages are growing: around ~4.1% (median, Aug), but price changes still matter for take-home power.

Credit cards bite: average APR near ~20.01%. Pay down balances if possible.

Government shutdown: National parks limit services, SBA 7(a)/504 loan processing pauses, and states warn SNAP* benefits may be delayed for November if the impasse continues.

🚪 Weekly Close

Rotation leaned toward Health Care, Energy, Real Estate and Consumer sectors; away from Basic Materials, Utilities and Financials (week-to-date). Breadth wasn’t great, but high-yield spreads* near ~2.97% suggest credit markets remain calm. Heading into next week, growth data and megacap earnings will steer risk appetite more than headlines alone.

What to watch:

Fri, Oct 24 — CPI (Sep): BLS* plans to publish despite the shutdown; key for COLA and markets.

Fri, Oct 24 — S&P Global flash PMIs*: fresh read on growth/prices while federal data paused.

Mon, Oct 27 — FAA air controller pay timing: missed checks could snarl flights, ding travel demand.

Tue–Wed, Oct 28–29 — FOMC meeting: rate path and balance-sheet cues.

Thu, Oct 30 — Q3 GDP* (BEA*): scheduled, but likely postponed during shutdown.

Fri, Oct 31 — Core PCE* inflation: also at risk of delay; still market-moving when released.

Sat, Nov 1 — SNAP issuance: risk date in some states if funding isn’t restored.

📚 Decoder

BEA (Bureau of Economic Analysis): Publishes GDP, income, and spending data.

BLS (Bureau of Labor Statistics): Publishes jobs, CPI, and productivity data.

Core PCE: Fed’s preferred inflation gauge; excludes food and energy.

GDP: Nation’s total value of goods/services produced; key growth measure.

High-yield spread (OAS): Extra yield junk bonds pay over Treasurys.

SNAP: Federal grocery benefits for low-income households.

PMI (Purchasing Managers’ Index): Monthly survey snapshot of business activity.

🕔 That wraps up your midweek 5-minute brief. There’s more info out there…dive in! News is free; risk isn’t.

We’ll be back before opening bell next Monday, at 7 AM ET. Be on the lookout for your next update from 5 Minute Markets.

Educational only—not investment advice.

A word from AltIndex…

When AI Outperforms the S&P 500 by 28.5%

Did you catch these stocks?

Robinhood is up over 220% year to date.

Seagate is up 198.25% year to date.

Palantir is up 139.17% this year.

AltIndex’s AI model rated every one of these stocks as a “buy” before it took off.

The kicker? They use alternative data like reddit comments, congress trades, and hiring data.

We’ve teamed up with AltIndex to give our readers free access to their app for a limited time.

The next top performer is already taking shape. Will you be looking at the right data?

Past performance does not guarantee future results. Investing involves risk including possible loss of principal.