📈 TL;DR – Last Week in 60 Seconds

Stocks ripped over the holiday week. The S&P 500 notched its best Thanksgiving stretch since 2008. Small caps led as rate hopes firmed. The U.S. dollar (DXY) slipped, easing financial conditions. Gold rose on growing Fed cut bets. Retailers drew attention as holiday shopping kicked off; early reads leaned solid, but investors want confirmation in coming data.

A green week for Bitcoin turned red during the weekend, signaling a possible risk-off start to December. Big picture: easier yields + softer dollar = tailwind for risk, but data and Fed speak can still swing sentiment quickly.

Quick Levels → Last week’s change

S&P 500: 6,849.08 | ↑3.73%

Nasdaq 100: 25,434.89 | ↑4.93%

Dow: 47,716.43 | ↑3.18%

Russell 2000: 2,500.43 | ↑5.52%

Gold/oz: $4,215 | ↑3.71%

Bitcoin (BTC): $90,382 | ↑3.91%

DXY (U.S. Dollar Index): 99.48 | ↓0.72%

🚀 Top Movers Last Week

Source: Bloomberg

SMX Security Matters (SMX) ↑1,207.07% — Jumped on announcement of breakthrough molecular-level identity markers for the rare earth industry at DMCC Precious Metals conference.

Kohl’s (KSS) ↑56.52% — Surprise profit and raised guidance; CEO made permanent, boosting turnaround hopes into holidays.

Symbotic (SYM) ↑56.17% — Post-earnings pop as warehouse automation demand and Walmart pipeline updates excited investors.

Intel (INTC) ↑17.57% — Talk Apple may tap Intel’s foundry lifted turnaround hopes; Black Friday volume amplified gains.

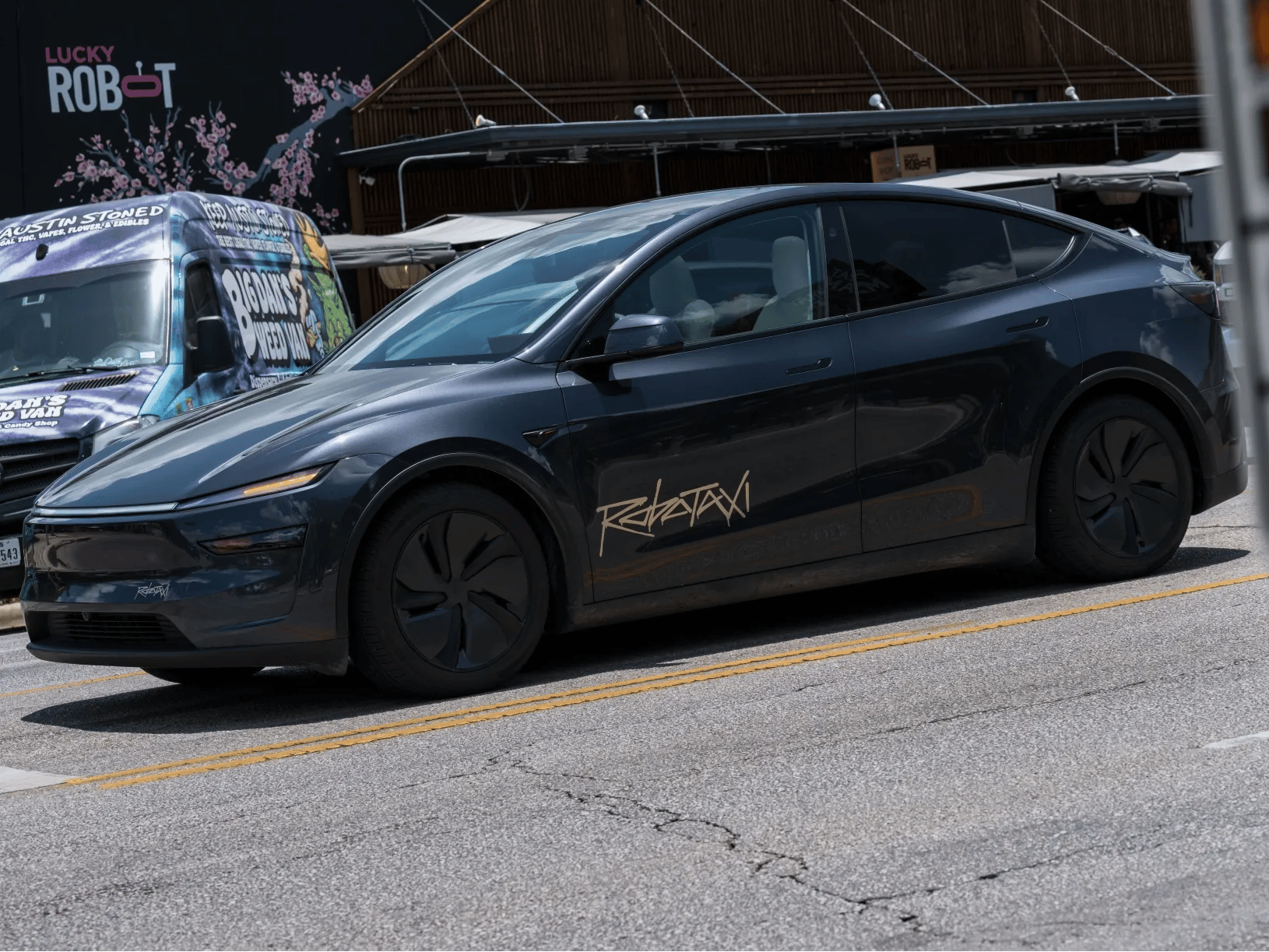

Tesla (TSLA) ↑9.99% — Rallied after Musk said Austin robotaxi fleet doubles in December; AI-chip chatter helped.

Meta Platforms (META) ↑9.04% — Jumped on reports it may buy Google TPUs, signaling aggressive AI build-out.

🗺 Market Map

Data cluster: Core PCE* Friday (10 a.m. ET), ISM Manufacturing today, ISM Services and jobs data Wednesday. Hot prints risk firmer yields and slower cuts; softer readings favor rate-sensitives and small caps. Fed Chair Powell speaks tonight at Stanford. Any hint on cuts could swing markets.

Global manufacturing is soft: China’s private PMI* dipped back below 50 in November, showing contraction. As the U.S. factory gauge arrives today, watch input-cost commentary—stickier costs can keep services inflation firm and complicate the Fed’s path. Read the Signal Spotlight blog for more depth.

Earnings backdrop is constructive: S&P 500 Q3 growth running in the low-teens year-over-year, with improving revenues. That gives some cushion if macro wobbles, though leadership remains concentrated.

OPEC+ kept output policy steady: Crude oil ticked higher to start the week. If Brent holds gains, energy shares and inflation expectations could firm—affecting gas prices and cyclicals sensitive to fuel costs.

🛒 Buy Zone

Long-term investors: Consider Utilities (defensive, dividend payers) as yields ease and financing costs stabilize. Regulated cash flows plus falling borrowing costs can help total returns. Guardrail: if Treasury yields rise sharply again, expect pressure on valuations and revisit allocation.

Short-term traders: “Data-reaction” setup in rate-sensitive pockets (software, REITs*, utilities). A sub-50 ISM and cooler Core PCE could spark squeezes; a firmer tone from Powell or hotter prints likely flips the script. Guardrail: pre-define stops into events.

💡 Signal Spotlight

December Fed cut: priced in, but not locked in

Futures put ~85% odds on a quarter-point cut at the December 9–10 FOMC. The case: cooler inflation, slower hiring, and manageable growth risks. Data gaps after the shutdown add noise, so the Fed may emphasize broader signals and its medium-term path.

Watch three swing factors this week: payroll/jobs data, ISM surveys, and Friday’s rescheduled core PCE release.

A word from EverQuote…

The best way to protect your assets

Insurance isn’t just another bill. It’s a key part of protecting everything you’ve worked hard to build. From your home to your vehicles, your coverage should reflect your current lifestyle and financial goals - not last year’s premiums.

EverQuote helps financial pros and those new to insurance compare personalized quotes for bundled home and auto policies, multi-car coverage, and more—all in one simple view. Keep your protection aligned with today’s market and ensure every dollar works harder for you.

👀 What to Watch

Mon, Dec 1 — ISM Manufacturing PMI: Factory momentum read; services inflation and demand breadth check. Continued reports sub-50 keeps recession chatter alive.

Mon, Dec 1 — Fed Chair Powell at Hoover Institution: Last major remarks before blackout.

Tue, Dec 2 — JOLTS (Sep, delayed): Job openings trend drives wage/cooling narrative before the Fed.

Wed, Dec 3 — ISM Services PMI: Services inflation and demand—key for the growth view.

Wed, Dec 3 — ADP Non-Farm payrolls: Private payroll pulse before government data.

Thu, Dec 4 — Weekly jobless claims: Fastest labor signal; persistent rises hint demand is fading.

Fri, Dec 5 — Personal Income & Outlays* (Sept): Core PCE path; consumer cashflow. Fed’s preferred inflation gauge; a hot print risks delaying easing.

📚 Decoder

Core PCE: Inflation measure excluding food and energy.

Personal Income & Outlays: Monthly BEA report of income, spending, savings, and PCE inflation.

PMI (Purchasing Managers’ Index): Survey of business activity; 50 separates expansion from contraction.

REIT (Real Estate Investment Trust): Companies that own income-producing real estate; distribute most taxable income as dividends.

🕔 That’s your 5-minute guide to start the week. There’s more info out there…dive in! News is free; risk isn’t.

We’ll be back to check-in on Thursday at 7 AM ET.

Educational only—not investment advice.