📈 TL;DR – Last Week in 60 Seconds

Amazon’s results kept megacaps in the driver’s seat, helping stocks notch another winning week. The Nasdaq extended its monthly streak, while small-caps lagged as investors stuck with “big, liquid, profitable” themes. Treasury yields eased a bit as traders weighed the U.S. central bank’s next move.

The dollar firmed; gold cooled after early-October fireworks; and Bitcoin slipped from recent records. Bottom line: leadership stayed narrow, but trends stayed intact—tech up, dollar up, defensives mixed.

Quick Levels → Last week’s change

S&P 500: 6,879.17 | ↑0.49%

Nasdaq 100: 25,858.13 | ↑0.61%

Dow: 47,562.87 | ↑0.32%

Russell 2000: 2,479.38 | ↓1.89%

Gold/oz: $4,002 | ↓2.71%

Bitcoin (BTC): $110,591 | ↓3.44%

U.S. Dollar Index (DXY): 99.72 | ↑0.79%

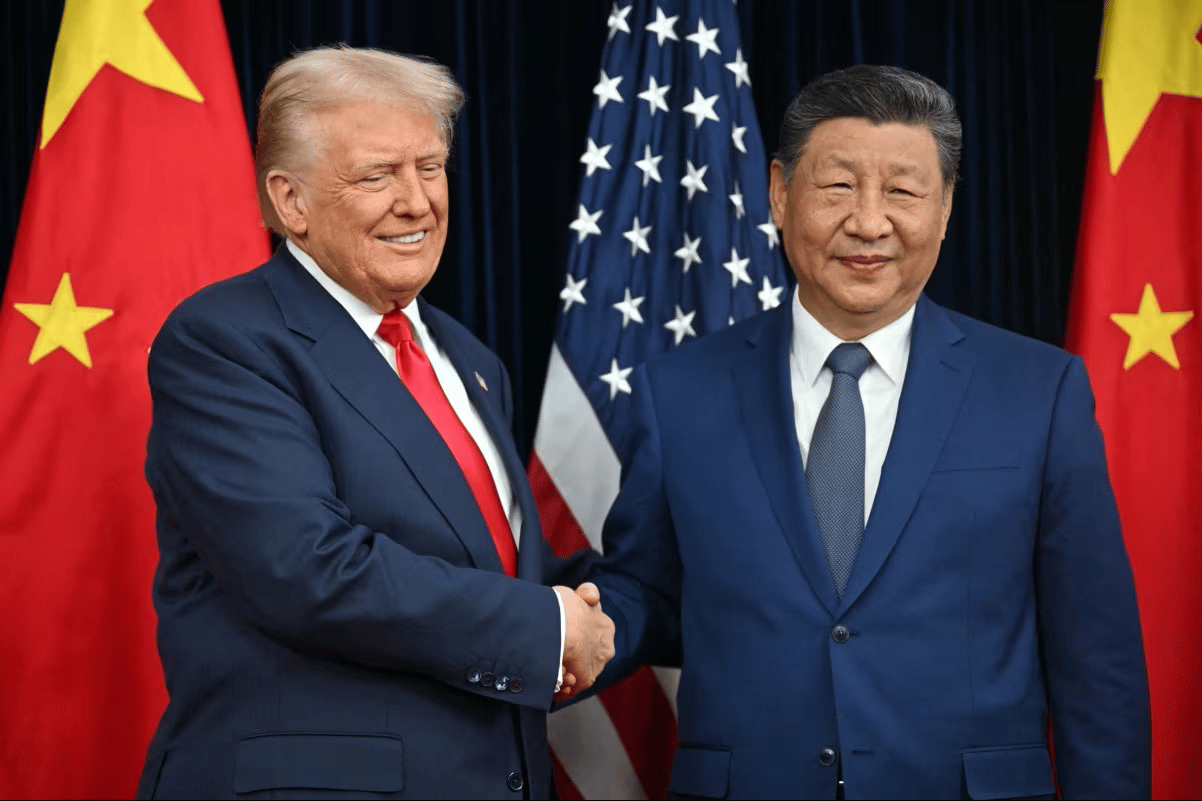

Source: Andrew Caballero-Reynolds/AFP/Getty Images

🚀 Top Movers Last Week

Twilio (TWLO): ↑19.83% — Post-earnings efficiency push and margin focus reignited interest in communications software.

Rigetti Computing (RGTI): ↑13.98% — Quantum name surged as investors chased AI-adjacent compute plays; liquidity remains thin.

Amazon (AMZN): ↑8.92% — Cloud growth re-accelerated to fastest pace in ~3 years; upbeat outlook and Q4 sales forecast lifted shares to records. Amazon also announced 14,000 layoffs last week.

Nvidia (NVDA): ↑8.71% — AI demand headlines, $5T valuation chatter and supercomputer plans fueled chip momentum.

Meta (META): ↓12.19% — Post-earnings expense outlook and $70–$72B 2025 capex ramp rattled sentiment amid AI infrastructure spend debate.

🗺 Market Map

Trump-Xi: trade thaw headlines: U.S. trims some tariffs; China pledges soybean buys, pauses rare-earth curbs, and steps up fentanyl policing. Details still emerging, but tone improved after the South Korea summit.

AI capex remains the market’s engine: Mega-caps raised spending plans again; Amazon and Apple earnings beats contrasted with Meta’s slide on bigger capex and a tax charge. The AI build-out is broadening to industrials and power equipment.

Post-FOMC speeches divided: After a 0.25% cut, officials split: Waller favors a December cut; others urge patience. Powell said another move isn’t guaranteed as labor data wobble.

Data week, with partial data: A government shutdown could delay Friday’s jobs report, so traders lean on ADP, ISM*, and central-bank decisions (BoE, RBA). A firmer dollar adds pressure to commodities and non-U.S. earnings translations.

🛒 Buy Zone

Long-term investors — Consider a measured add to Utilities & Grid infrastructure. U.S. power demand is set to hit fresh records in 2025–26 as data centers multiply, and regulators are pushing long-range transmission* planning—tailwinds for select utilities and grid owners. Risks: higher rates, regulatory pushback on returns, and project delays.

Short-term traders — Watch rate-sensitives (financials, homebuilders, utilities) around Treasury’s Quarterly Refunding Announcement (QRA) today and auction details Wed; with official data limited by the shutdown, ISM/ADP may swing yields. Guardrail: if long-end auction sizes or demand surprise, expect quick moves in 10-year notes.

💡 Signal Spotlight

Power is the new bottleneck: why AI could re-rate utilities.

AI is turning electricity into the next scarce input. U.S. demand is set to hit records, IEA* forecasts have moved higher, and PJM* shows faster local load growth. That supports multi-year grid capex, steadier earnings, and healthier dividends for well-run utilities—plus selective upside for dependable generation. Watch permitting and project costs, but the structural tailwind looks real.

👀 What to Watch

Mon, Nov 3 — ISM Manufacturing PMI: Early read on orders, hiring, and prices.

Mon, Nov 3 — Treasury Quarterly Refunding announcement*: Sizes/mix set the tone for yields and risk appetite.

Tue, Nov 4 — AMD earnings: AI demand check for chips, capex, and data centers.

Wed, Nov 5 — ISM Services PMI + ADP payrolls: Services momentum and labor snapshot.

Wed, Nov 5 — Qualcomm, McDonald’s & Robinhood earnings: Handsets, global consumers, and trading activity.

Thu–Fri, Nov 6–7 — Fed speeches: Policy tone can sway cut expectations and dollar/yields quickly.

Fri, Nov 7 — University of Michigan sentiment: Spending confidence and inflation expectations.

📚 Decoder

IEA (International Energy Agency): Global energy market research organization.

ISM (Institute for Supply Management): Surveys purchasing managers for activity levels.

PJM: Mid-Atlantic grid operator managing wholesale electricity markets.

Quarterly Refunding Announcement: Treasury’s plan for upcoming note/bond issuance.

Transmission (grid): High-voltage lines moving power long distances.

🕔 That’s your 5-minute guide to start the week. There’s more info out there…dive in! News is free; risk isn’t.

We’ll be back to check-in on Thursday at 7 AM ET.

Educational only—not investment advice.

A word from Long Angle…

How High-Net-Worth Families Invest Beyond the Balance Sheet

The 2025 High-Net-Worth Professional Services Report reveals what today’s wealthy families value most, what disappoints them, and where satisfaction truly comes from.

Learn why emotional well-being often outranks financial optimization.

See which services families are most likely to change — and which they’ll never give up.

Understand generational differences shaping how the wealthy live, work, and parent.

See how you compare to your peers.