📉 TL;DR – Last Week in 60 Seconds

Markets see-sawed after Nvidia’s earnings: chip stocks popped, then faded, and indexes whipsawed before a Friday rebound. The S&P 500 still finished the week lower. A New York Fed official hinted cuts may be “near,” helping stocks and easing yields late week. The U.S. dollar firmed while gold slipped and Bitcoin fell.

Net-net: leadership narrowed, volatility picked up, and traders are watching the next macro prints to see if the pullback deepens—or stabilizes into Thanksgiving week.

Quick Levels → Last week’s change

S&P 500: 6,602.98 | ↓1.95%

Nasdaq 100: 24,239.57 | ↓3.07%

Dow Jones: 46,245.42 | ↓1.91%

Russell 2000: 2,369.59 | ↓0.78%

Gold/oz: $4,065 | ↓0.51%

Bitcoin (BTC): $86,849 | ↓7.89%

U.S. Dollar Index (DXY): 100.20 | ↑0.93%

🚀 Top Movers Last Week

Regeneron Pharmaceuticals (REGN) ↑9.00% — FDA cleared Eylea HD for new use and monthly dosing, expanding addressable market.

Alphabet (GOOGL) ↑8.41% — Berkshire revealed ~$4.9B stake; AI/Gemini 3 optimism and fresh highs drew follow-through buying.

Ross Stores (ROST) ↑8.36% — Beat Q3 and raised full-year outlook; value shoppers kept spending ahead of holidays.

AMD (AMD) ↓17.43% — Chip selloff deepened; leaked AI-CPU benchmarks and reset expectations hit sentiment hard.

Veeva Systems (VEEV) ↓16.81% — Beat earnings, but CRM customer shifts spooked investors, swamping upbeat guidance.

🗺 Market Map

Source: Bloomberg

AI whiplash defined the week: Nvidia’s blowout quarter briefly lifted tech before valuation and AI-spend payback fears flipped sentiment, pushing the Nasdaq lower and volatility higher into the close.

Rates & odds: The U.S. central bank’s minutes signaled caution on rate cuts, keeping traders focused on inflation progress. Treasury yields hovered near ~4% on the 10-year into Friday, helping defensives late week. Further DXY strength would be a headwind for overseas revenues translated back into dollars.

Leadership narrowed: Alphabet outperformed even as the S&P 500’s weekly change was negative, a sign of selective buying rather than broad strength.

Jobs pulse: Weekly jobless claims fell to 220,000, but continuing claims hit the highest since 2021. Translation: layoffs stay low, rehiring looks slower—mixed signals for growth and wages.

Crypto stress deepened: Bitcoin sank into the low-$80Ks as spot-ETF outflows spiked—BlackRock’s IBIT saw a record daily withdrawal—signaling risk-off flows and forced de-risking.

🛒 Buy Zone

Long-term investors: Consider inching duration* higher in investment-grade bonds as the 10-year sits near ~4.10%. Higher starting yields can cushion returns if growth cools; if rates pop, reinvest at better levels. Keep maturities laddered and avoid reaching for yield.

Short-term traders: Semiconductors two-way setup. Nvidia’s post-earnings “pop-then-drop” turned the group choppy. Look for a trend-pullback reclaim (strength) or lower-high fade (weakness). Guardrail: keep risk outside the prior day’s range; expect fast moves. Keep size smaller into the holiday, respect stops if VIX* stays elevated.

💡 Signal Spotlight

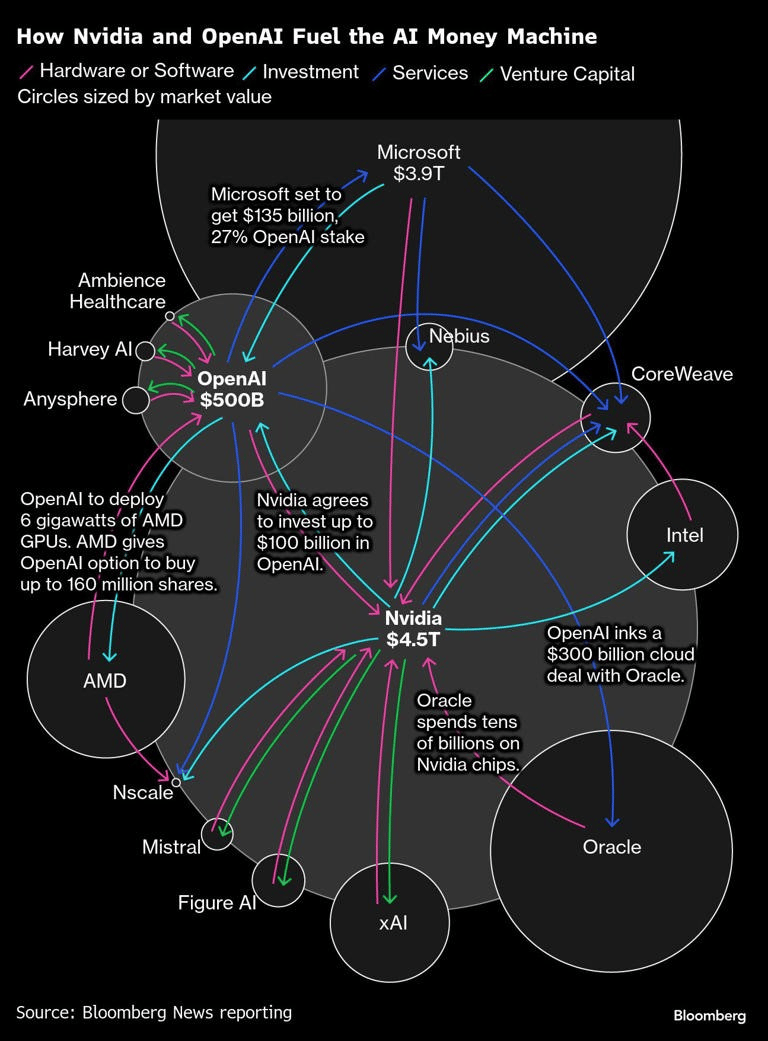

Circular financing in AI: what’s real, what matters

AI’s build-out leans on circular financing*—customers, clouds, and suppliers committing money to one another. Filings show NVIDIA’s receivables and inventories climbed with concentrated customer exposure, while OpenAI, CoreWeave, and Oracle announced giant, multi-year commitments.

None of this proves misconduct, but it raises sensitivity to cash collections and unused capacity. Watch three things: DSO*/collections, contract stickiness, and who backstops capacity. If AI revenue turns into cash, the loop stays virtuous; if not, expect a squeeze.

A word from Attio…

Introducing the first AI-native CRM

Connect your email, and you’ll instantly get a CRM with enriched customer insights and a platform that grows with your business.

With AI at the core, Attio lets you:

Prospect and route leads with research agents

Get real-time insights during customer calls

Build powerful automations for your complex workflows

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

👀 What to Watch

Tue, Nov 25 — BLS Producer Price Index (Sep, delayed): Pipeline inflation check—services vs. goods cost pressures.

Tue, Nov 25 — Consumer Confidence*: Sentiment steers holiday intent and big-ticket purchases.

Tue, Nov 25 — Case-Shiller home prices: Housing momentum and supply; feeds mortgage-rate expectations and consumer wealth effects.

Wed, Nov 26 — Weekly Jobless Claims: Early labor signal—watch continuing claims trend for softening or resilience.

Wed, Nov 26 — Fed Beige Book: Fed’s district survey anecdotes on demand, wages, and pricing power.

Thu-Fri, Nov 27-28 — U.S. markets closed (Thanksgiving); Early U.S. market close (Fri, 1 PM ET): Thin liquidity can magnify moves.

Sun, Nov 30 — OPEC+ meeting: Any quota tweak steers oil, inflation expectations, and rate-cut odds.

📚 Decoder

Circular financing: Interlinked funding/commitments where vendors, platforms, and customers finance each other’s demand.

Consumer Confidence (Conference Board): Survey of household views on jobs and spending.

DSO (Days Sales Outstanding): Average number of days to collect customer invoices after sale.

Duration: Rate-sensitivity of a bond’s price to yield changes.

VIX (Cboe Volatility Index): Options implied 30-day S&P 500 volatility; often called the fear gauge.

🕔 That’s your 5-minute guide to start the week. There’s more info out there…dive in! News is free; risk isn’t.

We’ll be back to check-in on Thursday at 7 AM ET.

Educational only—not investment advice.