📉 TL;DR — What Moved, What Didn’t

Stocks pressed higher into Wednesday’s close despite the U.S. shutdown. S&P 500 and Nasdaq 100 set fresh records. Gold hit another record as the dollar softened and bond yields eased. ADP said private payrolls fell 32k, and ISM Manufacturing* was 49.1—both support rate-cut hopes. The 10-year yield hovered near ~4.11%. Bitcoin climbed toward $119K. Friday’s official jobs report could slip if shutdown delays data.

Quick Levels → Week-to-date change

S&P 500: 6,711.20 | ↑0.74%

Nasdaq 100: 24,800.86 | ↑0.70%

Dow: 46,441.10 | ↑0.29%

Russell 2000: 2,443.36 | ↑0.03%

Gold/oz: $3,863.53 | ↑2.79%

Bitcoin (BTC): $118,455 | ↑5.54%

U.S. Dollar Index (DXY): 97.73 | ↓0.45%

🚀 Top Movers This Week

Source: Patrick T. Fallon/AFP via Getty Images

AES (AES): ↑16.09% — Spikes on report of a potential $38B takeover by BlackRock’s GIP.

Pfizer (PFE): ↑14.52% — Struck pricing deal that secures tariff relief; sector relief rally spilled across pharma.

Eli Lilly (LLY): ↑13.92% — Benefited from broad health care bid and weight-loss drug optimism.

WTI Crude Oil: ↓5.06% — Growth worries and supply headlines pressure energy after recent rebounds.

NVIDIA (NVDA): ↑5.08% — AI demand narrative + fresh target bumps; lower yields supported risk appetite.

😎 Market Mood

Stocks opened Q4 at records as healthcare led and tech steadied. The 10-year Treasury yield hovered near ~4.10% while the dollar slipped and gold set fresh highs. Traders now price a high chance of a Fed cut this month, even with a federal shutdown muddying near-term data. Rotation favored defensives and cash-rich mega caps.

Scenarios (next 1–2 weeks)

👌 Base Case (60%, Choppy): Yields drift between ~4.00–4.20%; stocks grind higher with rotation toward healthcare and quality tech. A clear read on jobs or CPI could firm this path.

☀️ Bull Case (25%, Calm/Choppy): Softer labor data + explicit Fed cut push 10-year below 4.00%; mega-cap tech re-leads and small caps follow.

🌩 Bear Case (15%, Stormy): Shutdown drags or inflation re-accelerates; yields jump back >4.30% and dollar firms, pressuring multiples.

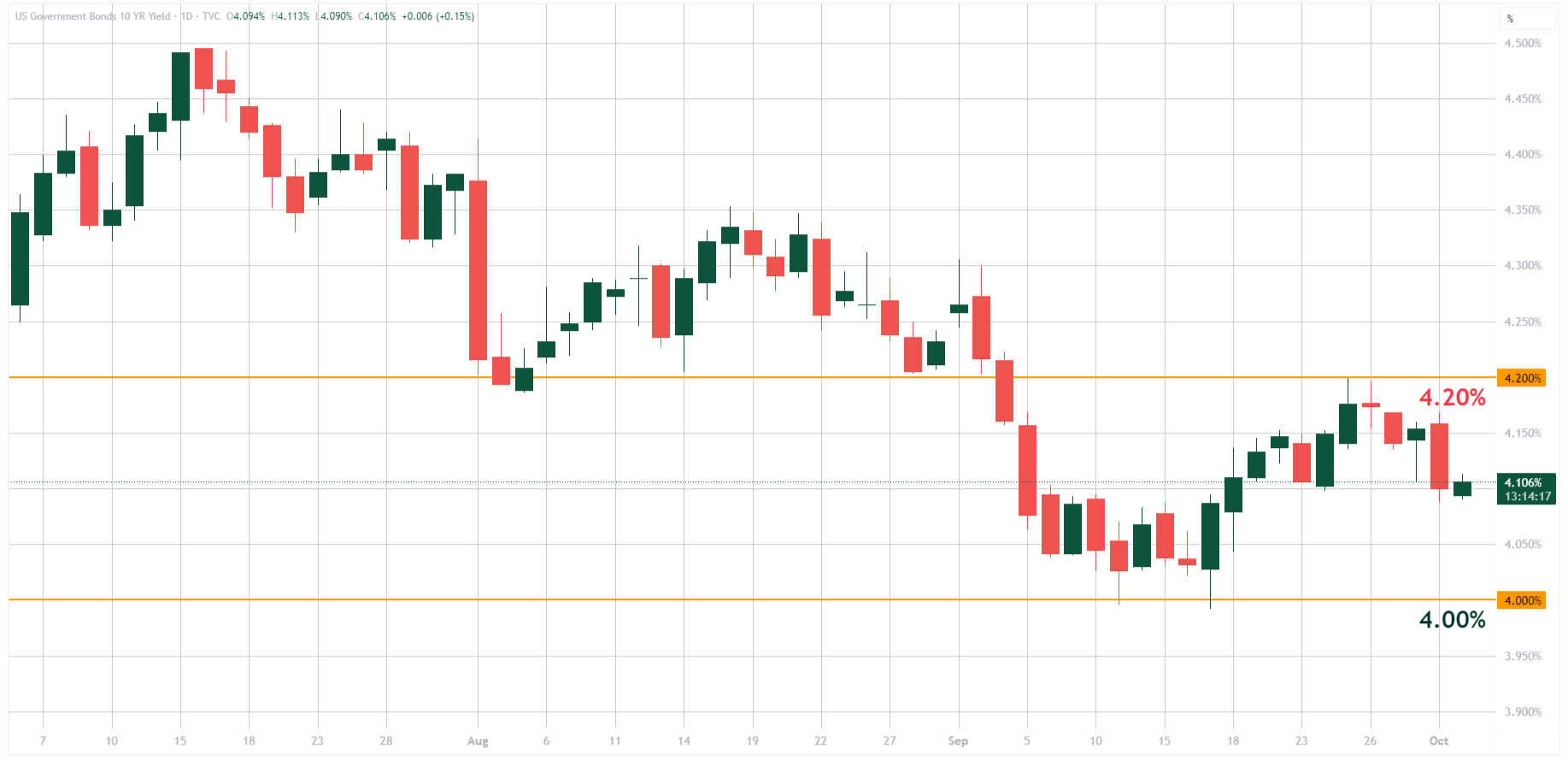

🔍 Chart of the Week

Symbol: U.S. 10-Year Treasury Yield (US10Y)

Timeframe: Daily chart; 3-month window through Oct 1, 2025

Key levels: 4.00% (support) and 4.20% (resistance).

Why it matters: A sustained break below 4.00% would ease pressure on valuations and mortgage rates; a rebound above 4.20-4.25% risks capping the equity/crypto run. Keep eyes on this hinge level.

🏠 Wall St. to Main St.

Mortgage check: The 30-year fixed is still elevated by recent standards, per Freddie Mac’s weekly Primary Mortgage Market Survey (PMMS*). Affordability is tight, so any dip helps buyers and refi math.

Gasoline: National average sits near $3.16/gal—roughly flat vs. a week ago—easing pressure at the pump for fall driving.

Paychecks: Wage gains are cooling, says the Atlanta Fed’s Wage Growth Tracker (WGT*). Slower wages plus cooling inflation means purchasing power steadies.

Groceries: USDA sees 2025 grocery-price inflation easing from last year, which supports household budgets if trends hold.

Growth pulse: GDPNow* estimate for Q3 sits at 3.8% (Oct 1). Solid growth underpins jobs and spending—key for earnings.

Note: A shutdown could delay COLA* timing if CPI is postponed.

🚪 Weekly Close

Rotation stayed selective into dividend payers and cash-rich brands, while rates-sensitive pockets waited on fresh data. Into Friday, the path likely hinges on jobs and services activity. Early next week, Fed minutes and earnings kick off the next narrative.

Upcoming catalysts:

Thu, Oct 2 (8:30 ET) — Initial Jobless Claims: labor chill check; may face shutdown delays.

Fri, Oct 3 (8:30 ET) — NFP*: headline jobs steers rate-cut odds; release scheduled.

Fri, Oct 3 (10:00 ET) — ISM Services PMI*: services drive earnings; watch new orders and prices.

Tue, Oct 7 (3:00 ET) — Fed G.19*: consumer credit and card rates; spending/firepower read.

Wed, Oct 8 — FOMC Minutes (Sep): Color on cut debate and inflation risk balance.

📚 Decoder

COLA (Cost-of-Living Adjustment): Social Security benefit raise from inflation.

Fed G.19 (Consumer Credit): Monthly consumer credit outstanding; revolving vs. nonrevolving, excludes mortgages.

GDPNow: Atlanta Fed’s model estimating current-quarter real GDP growth.

ISM Manufacturing: Monthly factory survey; 50 indicates growth, under 50 contraction.

ISM Services PMI: Monthly services-sector survey; 50 separates growth from contraction.

NFP (Non-farm payrolls): Monthly U.S. jobs report covering payrolls, unemployment rate, and wages.

PMMS (Primary Mortgage Market Survey): Freddie Mac’s weekly benchmark of mortgage rate averages.

Wage Growth Tracker (WGT): Median 12-month wage change for the same workers.

🕔 That wraps up your midweek 5-minute brief. There’s more info out there…dive in! News is free; risk isn’t.

We’ll be back before opening bell next Monday, at 7 AM ET. Meanwhile, be sure to check out our “3 after 5” weekly recap online Saturday afternoon.

Educational only—not investment advice.