📈 TL;DR – Last Week in 60 Seconds

A tariff shock rattled markets: stocks logged their worst single day since April after a 100% China tech-tariff threat, capping a down week for all major indexes. Gold punched to fresh records above $4,000 as investors hid in havens. Bitcoin tumbled into the weekend before stabilizing Sunday.

The U.S. dollar firmed into Monday’s Asia trade. Meanwhile, the 10-year Treasury yield hovered near 4.06%, keeping financial conditions tight. Futures bounced late Sunday after calmer White House remarks, but the tone remains fragile heading into a headline-heavy week.

Quick Levels → Last week’s change

S&P 500: 6,552.51 | ↓2.69%

Nasdaq 100: 24,221.74 | ↓3.06%

Dow: 45,479.60 | ↓2.77%

Russell 2000: 2,394.59 | ↓3.80%

Gold/oz: $4,016.68 | ↑3.35%

Bitcoin: $115,128.32 | ↓6.79%

DXY (U.S. dollar): 98.85 | ↑1.17%

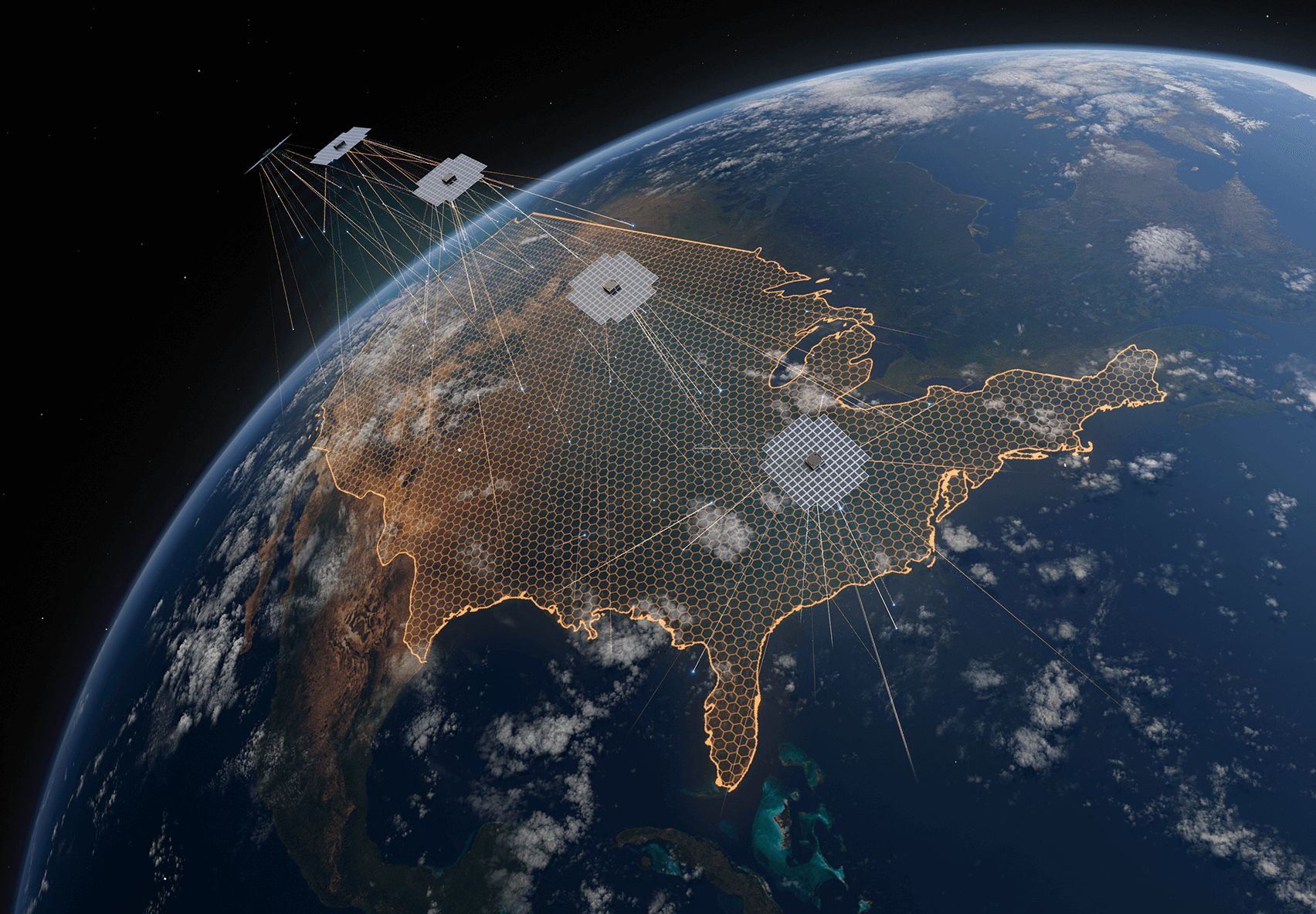

Source: ast-science.com

🚀 Top Movers Last Week

AST SpaceMobile (ASTS): ↑21.06% — Verizon partnership fueled “direct-to-cell” excitement and satellite-stock momentum. Big theme: coverage from space to standard phones.

QUALCOMM (QCOM) | ↓9.22% — China antitrust headlines plus tariff risk hit China-exposed revenues.

Bitcoin (BTC): ↓6.79% — Weekend flash crash as tariff headlines met weak momentum and thin liquidity.

Energy Select Sector (XLE): ↓4.15% — Energy stocks lagged; sector ETF slid on the week amid oil volatility.

VanEck Semiconductor ETF (SMH): ↓3.37% — Export-control talk and chip-tariff fears pressured the AI supply chain.

🗺 Market Map

Tariffs return to center stage. On Oct 10, President Trump threatened a 100% tariff on Chinese imports starting Nov 1; Beijing vowed “corresponding measures.” Semis and megacaps led Friday’s slump; futures steadied after softer remarks.

Data blackout complicates the read. A federal shutdown paused key reports; September CPI now due Oct 24. With payrolls delayed, investors lean on private gauges while volatility tracks headlines.

Crypto spillover watch. A $19B weekend wipeout and momentum breaks flagged leverage unwind risk; watch for knock-on effects to high-beta stocks early this week.

Supply chains in focus. China’s rare earths squeeze threat raises cost risk for tech/EV makers; markets will parse any U.S.–China de-escalation signs before repricing manufacturing margins.

🛒 Buy Zone

Long-term investors — Tilt toward “made-in-America” builders—industrial equipment, electrical gear, and grid/data-center suppliers set to benefit from re-shoring* and factory upgrades. Favor companies with pricing power and low China revenue. Guardrail: watch gross margins and backlog trends on earnings this week.

Short-term traders — Semi supply chain is headline-sensitive post-tariff shock. Look for failed bounces into resistance on tariff headlines; consider tight stops below last week’s lows and scale risk small ahead of bank/TSMC prints.

💡 Signal Spotlight

Why last week’s China tariff threat matters.

The U.S. threatened 100% tariffs on Chinese goods after Beijing tightened rare-earths exports. Washington later softened tone, but markets now price higher supply-chain and earnings risk. First-order hit: import-heavy sectors; potential beneficiary: domestic suppliers. Watch for Section 301 details and any Chinese response. Bottom line: more policy noise, fatter tail-risks, and a stronger case for diversification plus selective “made-here” exposure.

👀 What to Watch

All week — Big bank earnings (JPMorgan Tue): First read on credit costs, loan growth, and deposit trends; sets season tone.

Mon, Oct 13 — U.S. bond market closed: Liquidity thinner; equities still open and trading normally.

Tue, Oct 14 — Fed Chair Powell speaks + Beige Book* release (Oct 15): clues on growth/inflation mix while official data are delayed.

Wed, Oct 15 — ASML Q3 results: Key read on chip-equipment orders and AI demand.

Thu, Oct 16 — Weekly jobless claims: Fresh check on labor softening or resilience.

Thu, Oct 16 — Retail Sales: Signals goods demand into the holidays; core control group matters for GDP.

Thu, Oct 16 — PMMS* mortgage rates: Fresh snapshot for housing affordability.

Fri, Oct 17 — Univ. of Michigan Sentiment (prelim): Confidence + inflation expectations steer rate-cut odds.

📚 Decoder

Beige Book: Fed’s eight-times-yearly survey of regional business conditions and anecdotes.

Re-shoring: Moving production back home to cut risk and improve resilience.

PMMS: Freddie Mac’s weekly U.S. mortgage rate survey, widely watched benchmark.

🕔 That’s your 5-minute guide to start the week. There’s more info out there…dive in! News is free; risk isn’t.

We’ll be back to check-in on Thursday at 7 AM ET.

Educational only—not investment advice.

A word from Masterworks…

Where to Invest $100,000 According to Experts

Investors face a dilemma. Headlines everywhere say tariffs and AI hype are distorting public markets.

Now, the S&P is trading at over 30x earnings—a level historically linked to crashes.

And the Fed is lowering rates, potentially adding fuel to the fire.

Bloomberg asked where experts would personally invest $100,000 for their September edition. One surprising answer? Art.

It’s what billionaires like Bezos, Gates, and the Rockefellers have used to diversify for decades.

Why?

Contemporary art prices have appreciated 11.2% annually on average

…And with one of the lowest correlations to stocks of any major asset class (Masterworks data, 1995-2024).

Ultra-high net worth collectors (>$50M) allocated 25% of their portfolios to art on average. (UBS, 2024)

Thanks to the world’s premiere art investing platform, now anyone can access works by legends like Banksy, Basquiat, and Picasso—without needing millions. Want in? Shares in new offerings can sell quickly but…

*Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.